Summary

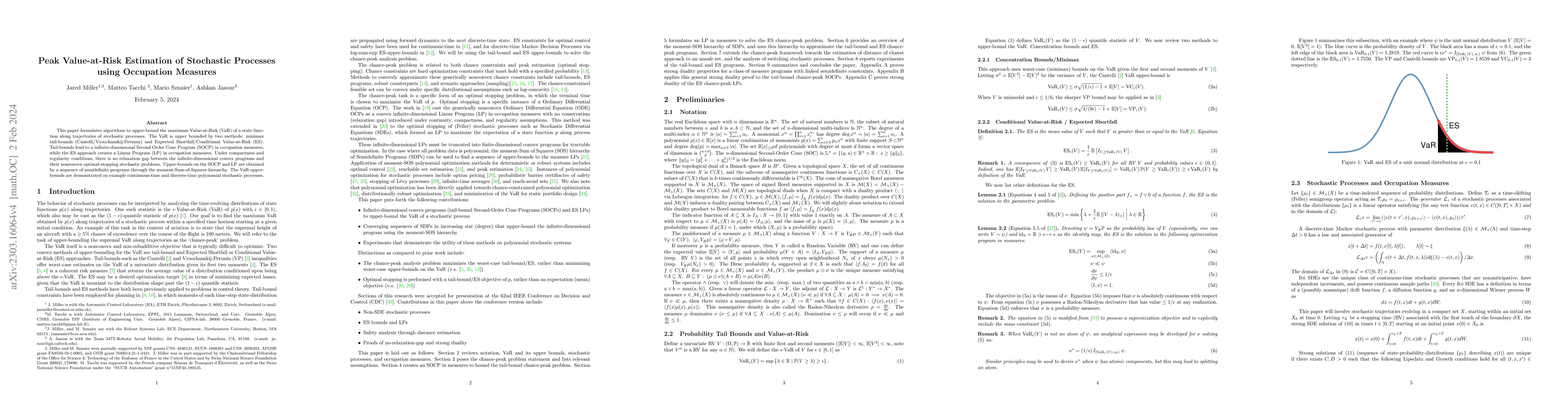

This paper formulates algorithms to upper-bound the maximum Value-at-Risk (VaR) of a state function along trajectories of stochastic processes. The VaR is upper bounded by two methods: minimax tail-bounds (Cantelli/Vysochanskij-Petunin) and Expected Shortfall/Conditional Value-at-Risk (ES). Tail-bounds lead to a infinite-dimensional Second Order Cone Program (SOCP) in occupation measures, while the ES approach creates a Linear Program (LP) in occupation measures. Under compactness and regularity conditions, there is no relaxation gap between the infinite-dimensional convex programs and their nonconvex optimal-stopping stochastic problems. Upper-bounds on the SOCP and LP are obtained by a sequence of semidefinite programs through the moment-Sum-of-Squares hierarchy. The VaR-upper-bounds are demonstrated on example continuous-time and discrete-time polynomial stochastic processes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPeak Time-Windowed Risk Estimation of Stochastic Processes

Didier Henrion, Jared Miller, Niklas Schmid et al.

Peak Estimation of Time Delay Systems using Occupation Measures

Mario Sznaier, Milan Korda, Victor Magron et al.

Peak Estimation and Recovery with Occupation Measures

Didier Henrion, Mario Sznaier, Jared Miller

Non-asymptotic estimation of risk measures using stochastic gradient Langevin dynamics

Ludovic Tangpi, Jiarui Chu

| Title | Authors | Year | Actions |

|---|

Comments (0)