Summary

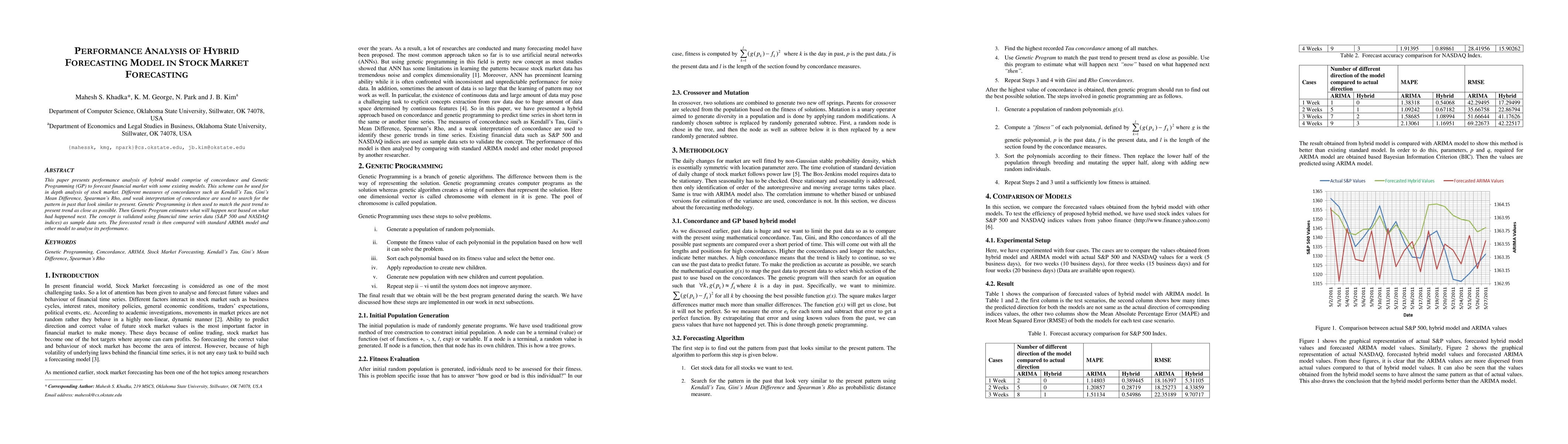

This paper presents performance analysis of hybrid model comprise of concordance and Genetic Programming (GP) to forecast financial market with some existing models. This scheme can be used for in depth analysis of stock market. Different measures of concordances such as Kendalls Tau, Ginis Mean Difference, Spearmans Rho, and weak interpretation of concordance are used to search for the pattern in past that look similar to present. Genetic Programming is then used to match the past trend to present trend as close as possible. Then Genetic Program estimates what will happen next based on what had happened next. The concept is validated using financial time series data (S&P 500 and NASDAQ indices) as sample data sets. The forecasted result is then compared with standard ARIMA model and other model to analyse its performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting the Performance of US Stock Market Indices During COVID-19: RF vs LSTM

Ali Lashgari, Reza Nematirad, Amin Ahmadisharaf

MASTER: Market-Guided Stock Transformer for Stock Price Forecasting

Yanyan Shen, Zhaoyang Liu, Tong Li et al.

A Neuro-Fuzzy System for Interpretable Long-Term Stock Market Forecasting

Vitomir Štruc, Igor Škrjanc, Miha Ožbot

| Title | Authors | Year | Actions |

|---|

Comments (0)