Authors

Summary

This paper characterises dynamic linkages arising from shocks with heterogeneous degrees of persistence. Using frequency domain techniques, we introduce measures that identify smoothly varying links of a transitory and persistent nature. Our approach allows us to test for statistical differences in such dynamic links. We document substantial differences in transitory and persistent linkages among US financial industry volatilities, argue that they track heterogeneously persistent sources of systemic risk, and thus may serve as a useful tool for market participants.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

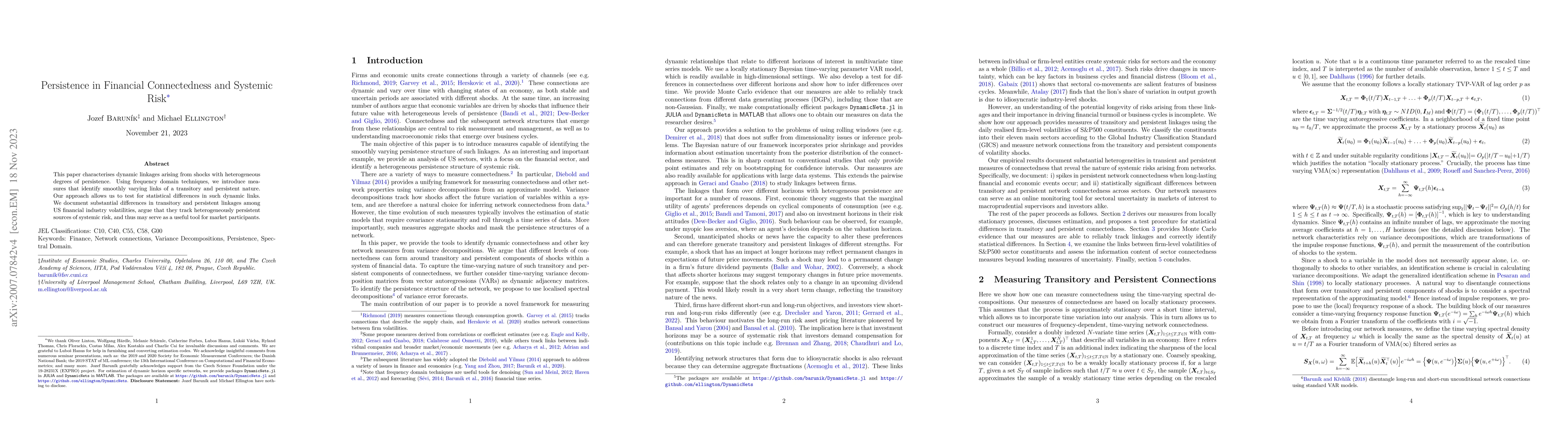

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGlobal Balance and Systemic Risk in Financial Correlation Networks

Fernando Diaz-Diaz, Paolo Bartesaghi, Rosanna Grassi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)