Summary

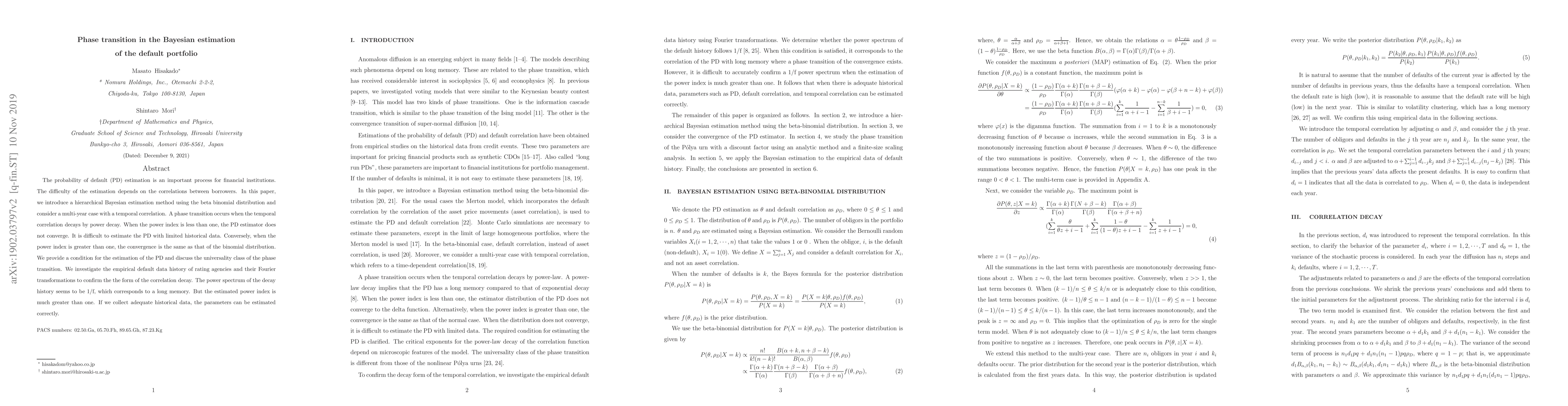

The probability of default (PD) estimation is an important process for financial institutions. The difficulty of the estimation depends on the correlations between borrowers. In this paper, we introduce a hierarchical Bayesian estimation method using the beta binomial distribution and consider a multi-year case with a temporal correlation. A phase transition occurs when the temporal correlation decays by power decay. When the power index is less than one, the PD estimator does not converge. It is difficult to estimate the PD with limited historical data. Conversely, when the power index is greater than one, the convergence is the same as that of the binomial distribution. We provide a condition for the estimation of the PD and discuss the universality class of the phase transition. We investigate the empirical default data history of rating agencies and their Fourier transformations to confirm the form of the correlation decay. The power spectrum of the decay history seems to be 1/f, which corresponds to a long memory. But the estimated power index is much greater than one. If we collect adequate historical data,the parameters can be estimated correctly.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian Estimation of Corporate Default Spreads

Maksim Papenkov, Beau Robinette

Delegated portfolio management with random default

Thibaut Mastrolia, Alberto Gennaro

| Title | Authors | Year | Actions |

|---|

Comments (0)