Authors

Summary

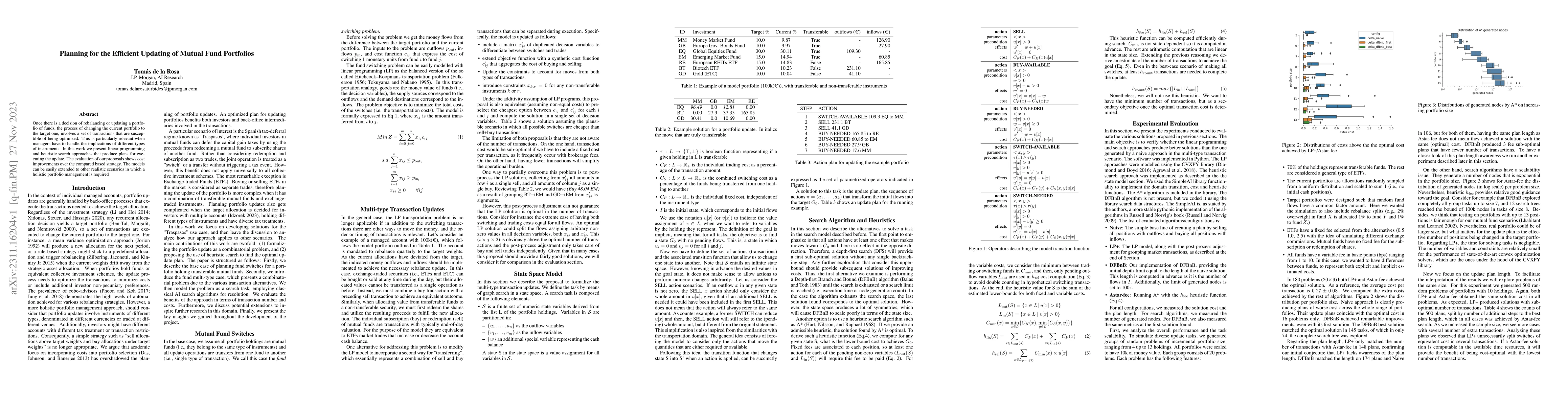

Once there is a decision of rebalancing or updating a portfolio of funds, the process of changing the current portfolio to the target one, involves a set of transactions that are susceptible of being optimized. This is particularly relevant when managers have to handle the implications of different types of instruments. In this work we present linear programming and heuristic search approaches that produce plans for executing the update. The evaluation of our proposals shows cost improvements over the compared based strategy. The models can be easily extended to other realistic scenarios in which a holistic portfolio management is required

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)