Summary

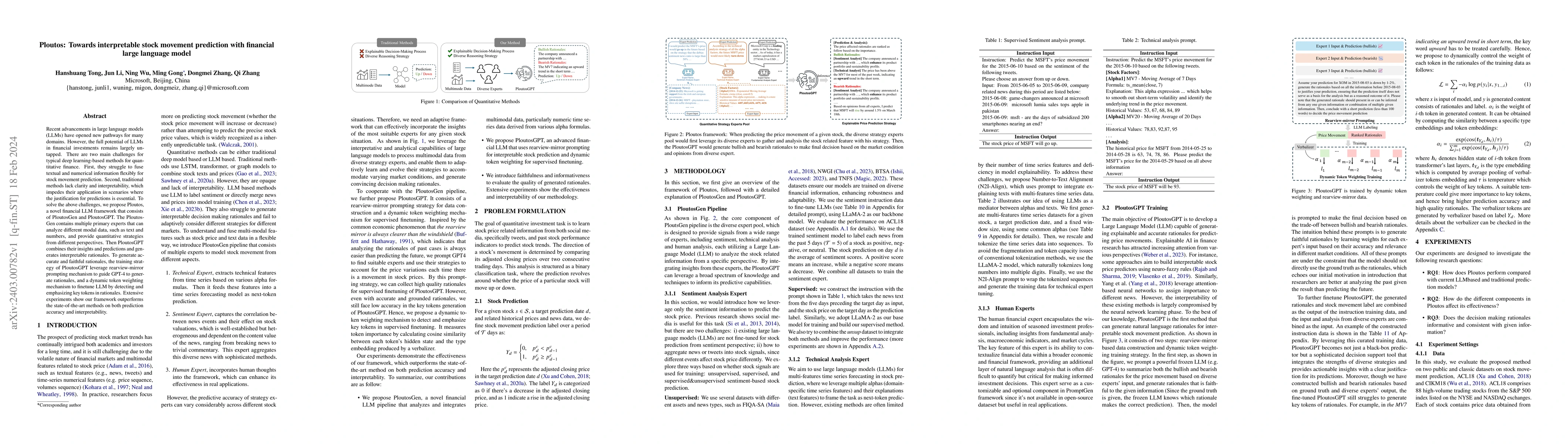

Recent advancements in large language models (LLMs) have opened new pathways for many domains. However, the full potential of LLMs in financial investments remains largely untapped. There are two main challenges for typical deep learning-based methods for quantitative finance. First, they struggle to fuse textual and numerical information flexibly for stock movement prediction. Second, traditional methods lack clarity and interpretability, which impedes their application in scenarios where the justification for predictions is essential. To solve the above challenges, we propose Ploutos, a novel financial LLM framework that consists of PloutosGen and PloutosGPT. The PloutosGen contains multiple primary experts that can analyze different modal data, such as text and numbers, and provide quantitative strategies from different perspectives. Then PloutosGPT combines their insights and predictions and generates interpretable rationales. To generate accurate and faithful rationales, the training strategy of PloutosGPT leverage rearview-mirror prompting mechanism to guide GPT-4 to generate rationales, and a dynamic token weighting mechanism to finetune LLM by increasing key tokens weight. Extensive experiments show our framework outperforms the state-of-the-art methods on both prediction accuracy and interpretability.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research proposes Ploutos, a financial large language model (LLM) framework for stock movement prediction. Ploutos consists of PloutosGen, which contains multiple primary experts analyzing different modal data, and PloutosGPT, which combines their insights and generates interpretable rationales using a rearview-mirror prompting mechanism and dynamic token weighting.

Key Results

- Ploutos significantly outperforms both traditional and LLM-based methods in stock movement prediction accuracy and interpretability.

- The ablation study demonstrates the importance of each component within the Ploutos architecture, with the full model achieving the best performance.

- Ploutos exhibits superior faithfulness and informativeness in interpretability compared to other LLM methods.

- The rearview-mirror data training strategy proves effective in generating informative rationales.

- Dynamic token weighting enhances predictive accuracy and interpretability synergistically.

Significance

This research is significant as it unlocks the text and numerical data understanding capabilities of LLMs for stock movement prediction, providing interpretable decision-making rationales, which is crucial for financial applications where justification for predictions is essential.

Technical Contribution

Ploutos introduces a novel training approach called rearview-mirror prompting and dynamic token weighting, designed to dynamically incorporate insights from diverse quantitative strategy experts, encompassing both sentiment and technical analysis.

Novelty

Ploutos stands out by addressing the challenges of fusing textual and numerical information flexibly for stock movement prediction and providing interpretable rationales, which is a significant improvement over traditional methods lacking clarity and interpretability.

Limitations

- The performance of PloutosGPT is dependent on the selection and performance of diverse quantitative strategy experts, which need thorough examination.

- The computational cost of the model, especially with large-scale data, can be high, posing a challenge for efficiency optimization without compromising predictive accuracy.

- Currently, the model focuses on textual and numerical data; incorporating other types of data, such as visual data, could potentially improve its performance.

Future Work

- Investigate methods for more efficient expert selection and performance evaluation.

- Explore techniques to optimize the model for efficiency without sacrificing predictive accuracy.

- Expand the model to incorporate various data types, such as visual data, to enhance its performance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCombining Financial Data and News Articles for Stock Price Movement Prediction Using Large Language Models

Ali Elahi, Fatemeh Taghvaei

Spatiotemporal Transformer for Stock Movement Prediction

Jugal Kalita, Daniel Boyle

Incorporating Pre-trained Model Prompting in Multimodal Stock Volume Movement Prediction

Yi Liu, Xu Sun, Zhiyuan Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)