Authors

Summary

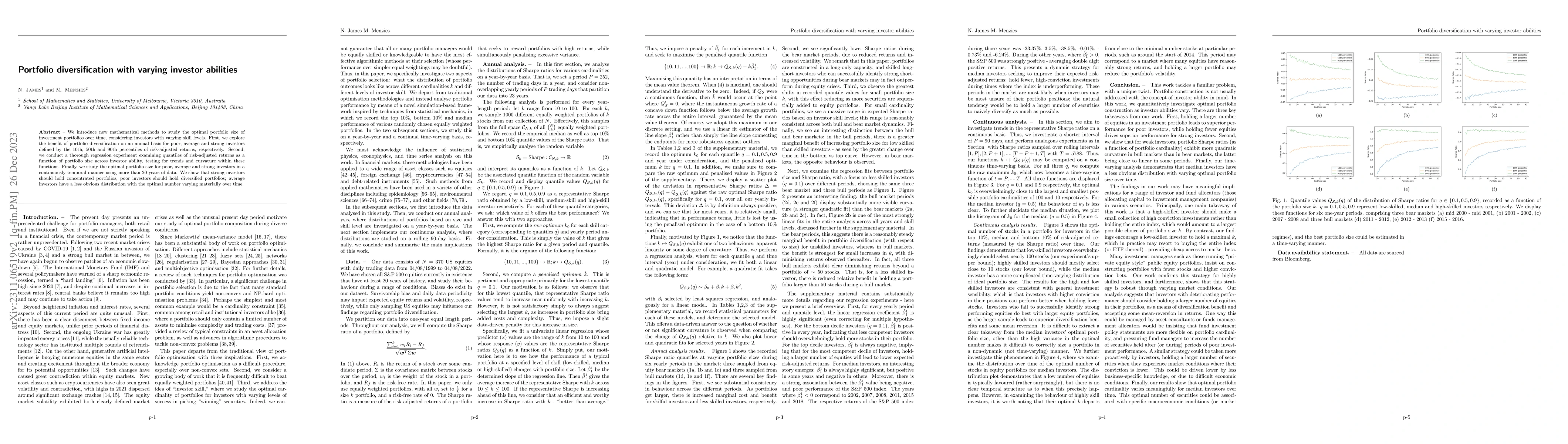

We introduce new mathematical methods to study the optimal portfolio size of investment portfolios over time, considering investors with varying skill levels. First, we explore the benefit of portfolio diversification on an annual basis for poor, average and strong investors defined by the 10th, 50th and 90th percentiles of risk-adjusted returns, respectively. Second, we conduct a thorough regression experiment examining quantiles of risk-adjusted returns as a function of portfolio size across investor ability, testing for trends and curvature within these functions. Finally, we study the optimal portfolio size for poor, average and strong investors in a continuously temporal manner using more than 20 years of data. We show that strong investors should hold concentrated portfolios, poor investors should hold diversified portfolios; average investors have a less obvious distribution with the optimal number varying materially over time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)