Summary

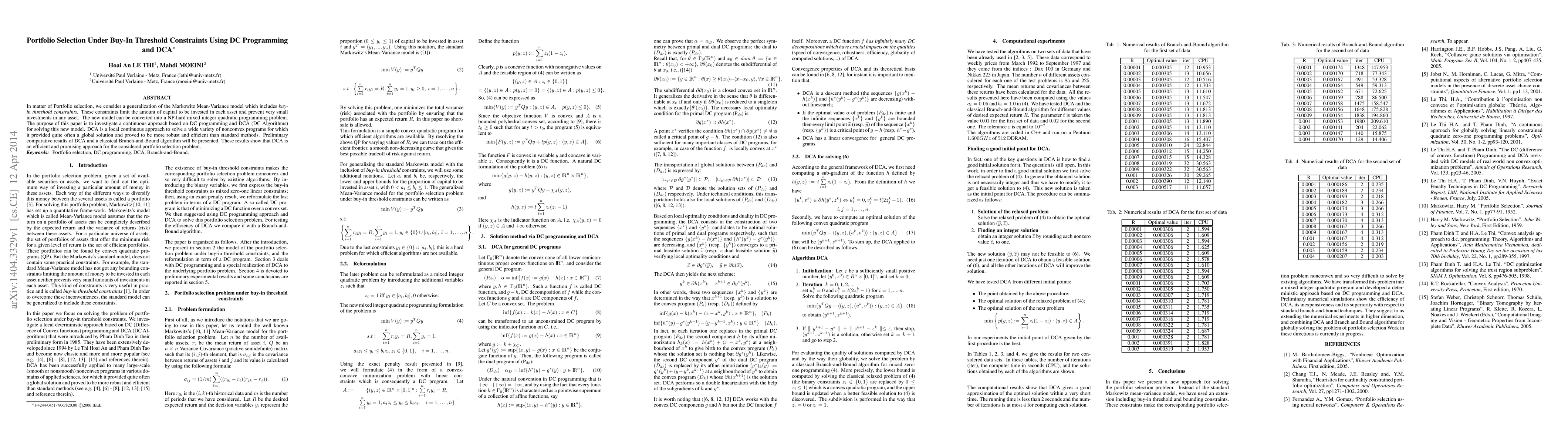

In matter of Portfolio selection, we consider a generalization of the Markowitz Mean-Variance model which includes buy-in threshold constraints. These constraints limit the amount of capital to be invested in each asset and prevent very small investments in any asset. The new model can be converted into a NP-hard mixed integer quadratic programming problem. The purpose of this paper is to investigate a continuous approach based on DC programming and DCA for solving this new model. DCA is a local continuous approach to solve a wide variety of nonconvex programs for which it provided quite often a global solution and proved to be more robust and efficient than standard methods. Preliminary comparative results of DCA and a classical Branch-and-Bound algorithm will be presented. These results show that DCA is an efficient and promising approach for the considered portfolio selection problem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)