Summary

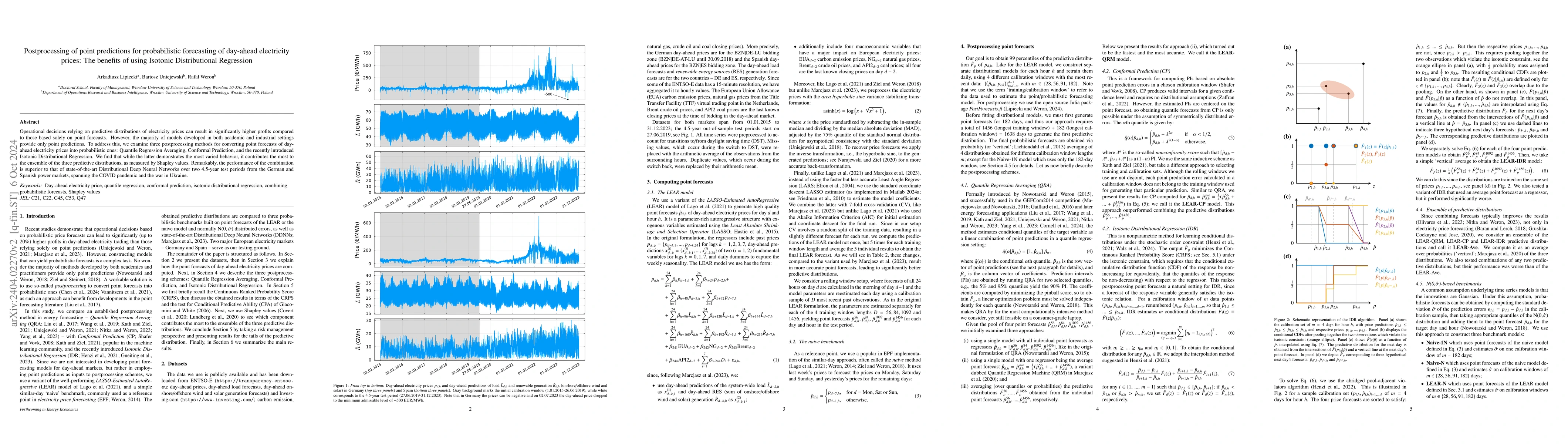

Operational decisions relying on predictive distributions of electricity prices can result in significantly higher profits compared to those based solely on point forecasts. However, the majority of models developed in both academic and industrial settings provide only point predictions. To address this, we examine three postprocessing methods for converting point forecasts into probabilistic ones: Quantile Regression Averaging, Conformal Prediction, and the recently introduced Isotonic Distributional Regression. We find that while IDR demonstrates the most varied performance, combining its predictive distributions with those of the other two methods results in an improvement of ca. 7.5% compared to a benchmark model with normally distributed errors, over a 4.5-year test period in the German power market spanning the COVID pandemic and the war in Ukraine. Remarkably, the performance of this combination is at par with state-of-the-art Distributional Deep Neural Networks.

AI Key Findings

Generated Sep 02, 2025

Methodology

The study examines three postprocessing methods for converting point forecasts into probabilistic ones: Quantile Regression Averaging, Conformal Prediction, and Isotonic Distributional Regression. These methods are applied to point forecasts generated by the LEAR model, which is trained daily using different calibration windows with the most recent data.

Key Results

- IDR demonstrates the most varied performance among the three methods.

- Combining IDR's predictive distributions with those of QRA and CP improves performance by approximately 7.5% compared to a benchmark model with normally distributed errors.

- The combined model's performance is comparable to state-of-the-art Distributional Deep Neural Networks.

- The LEAR-Ave ensemble model outperforms the DDNN-JSU benchmark over a 4.5-year test period in the German and Spanish power markets.

- All LEAR-based models significantly outperform the DDNN-JSU model, especially during periods of extreme price volatility.

Significance

This research highlights post-processing as a relatively simple and well-performing means of deriving predictive distributions from point forecasts in challenging environments like electricity price forecasting.

Technical Contribution

The paper introduces Isotonic Distributional Regression (IDR) and Conformal Prediction (CP) for electricity price forecasting, demonstrating their effectiveness in improving the accuracy of probabilistic forecasts.

Novelty

This study is one of the first to apply IDR and CP to electricity price forecasting, emphasizing the importance of diversity in pooling forecasts for improved predictive performance.

Limitations

- The study does not explore the impact of frequent, time-consuming hyperparameter optimization on the performance of the DDNN-JSU model during extreme price periods.

- The research focuses on a limited set of postprocessing methods and does not investigate other potential techniques.

Future Work

- Investigate the potential benefits of frequent hyperparameter optimization for the DDNN-JSU model during periods of extreme price volatility.

- Explore additional postprocessing methods and compare their performance with the methods studied in this research.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProbabilistic forecasting of German electricity imbalance prices

Michał Narajewski

Expectile regression averaging method for probabilistic forecasting of electricity prices

Joanna Janczura

Bayesian Hierarchical Probabilistic Forecasting of Intraday Electricity Prices

Daniel Nickelsen, Gernot Müller

Adaptive probabilistic forecasting of French electricity spot prices

Grégoire Dutot, Margaux Zaffran, Olivier Féron et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)