Summary

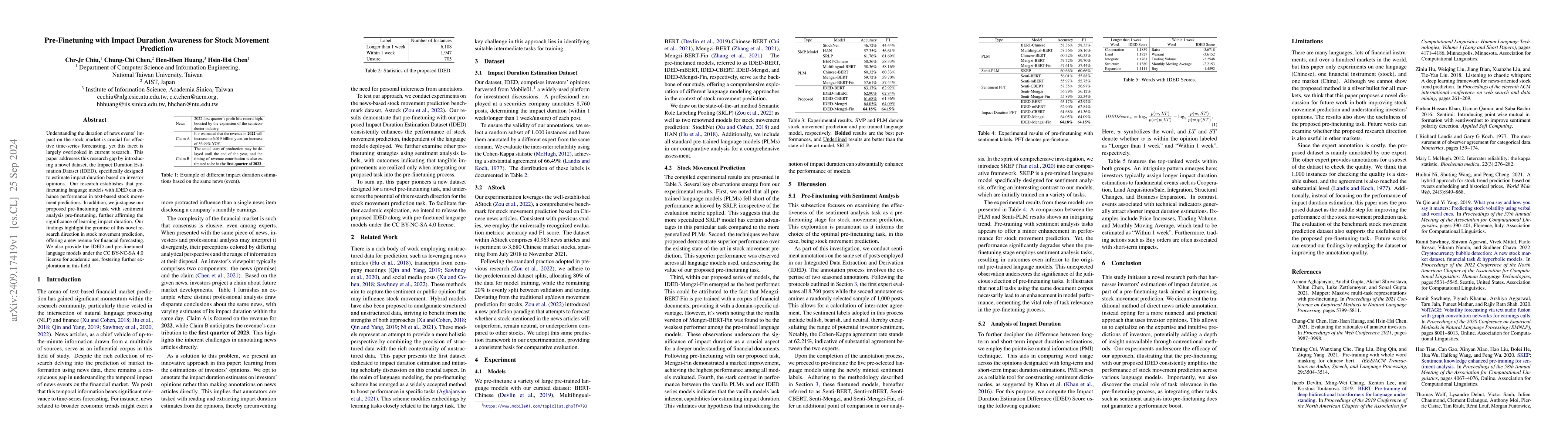

Understanding the duration of news events' impact on the stock market is crucial for effective time-series forecasting, yet this facet is largely overlooked in current research. This paper addresses this research gap by introducing a novel dataset, the Impact Duration Estimation Dataset (IDED), specifically designed to estimate impact duration based on investor opinions. Our research establishes that pre-finetuning language models with IDED can enhance performance in text-based stock movement predictions. In addition, we juxtapose our proposed pre-finetuning task with sentiment analysis pre-finetuning, further affirming the significance of learning impact duration. Our findings highlight the promise of this novel research direction in stock movement prediction, offering a new avenue for financial forecasting. We also provide the IDED and pre-finetuned language models under the CC BY-NC-SA 4.0 license for academic use, fostering further exploration in this field.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIncorporating Pre-trained Model Prompting in Multimodal Stock Volume Movement Prediction

Yi Liu, Xu Sun, Zhiyuan Zhang et al.

Spatiotemporal Transformer for Stock Movement Prediction

Jugal Kalita, Daniel Boyle

No citations found for this paper.

Comments (0)