Summary

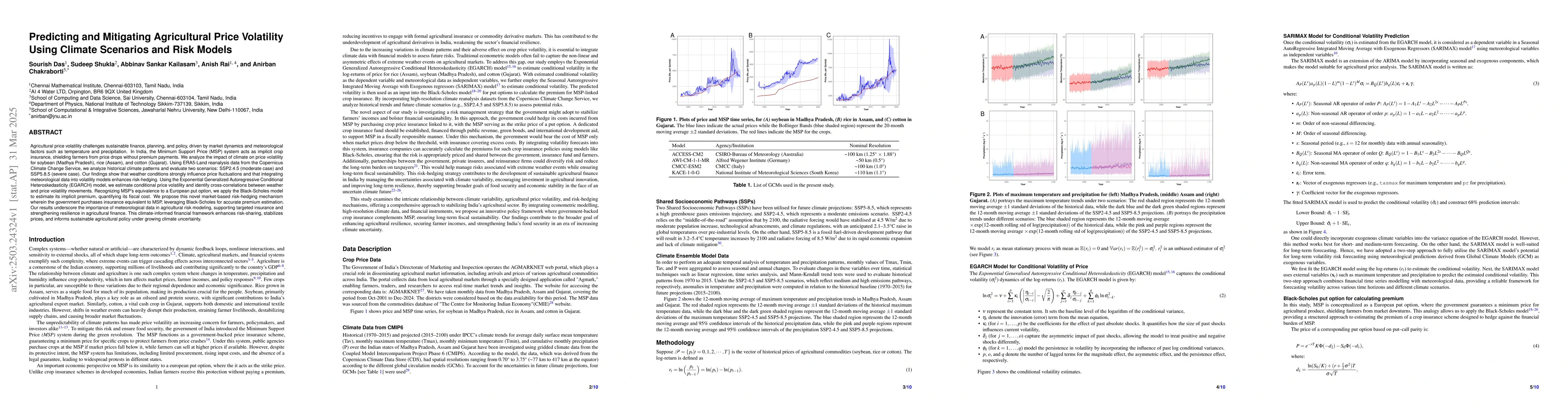

Agricultural price volatility challenges sustainable finance, planning, and policy, driven by market dynamics and meteorological factors such as temperature and precipitation. In India, the Minimum Support Price (MSP) system acts as implicit crop insurance, shielding farmers from price drops without premium payments. We analyze the impact of climate on price volatility for soybean (Madhya Pradesh), rice (Assam), and cotton (Gujarat). Using ERA5-Land reanalysis data from the Copernicus Climate Change Service, we analyze historical climate patterns and evaluate two scenarios: SSP2.4.5 (moderate case) and SSP5.8.5 (severe case). Our findings show that weather conditions strongly influence price fluctuations and that integrating meteorological data into volatility models enhances risk-hedging. Using the Exponential Generalized Autoregressive Conditional Heteroskedasticity (EGARCH) model, we estimate conditional price volatility and identify cross-correlations between weather and price volatility movements. Recognizing MSP's equivalence to a European put option, we apply the Black-Scholes model to estimate its implicit premium, quantifying its fiscal cost. We propose this novel market-based risk-hedging mechanism wherein the government purchases insurance equivalent to MSP, leveraging Black-Scholes for accurate premium estimation. Our results underscore the importance of meteorological data in agricultural risk modeling, supporting targeted insurance and strengthening resilience in agricultural finance. This climate-informed financial framework enhances risk-sharing, stabilizes prices, and informs sustainable agricultural policy under growing climate uncertainty.

AI Key Findings

Generated Jun 10, 2025

Methodology

The study uses ERA5-Land reanalysis data from the Copernicus Climate Change Service to analyze historical climate patterns for soybean (Madhya Pradesh), rice (Assam), and cotton (Gujarat). It employs the Exponential Generalized Autoregressive Conditional Heteroskedasticity (EGARCH) model to estimate conditional price volatility and cross-correlations between weather and price volatility movements. The Black-Scholes model is applied to estimate the fiscal cost of India's Minimum Support Price (MSP) system, likened to a European put option.

Key Results

- Weather conditions strongly influence agricultural price fluctuations.

- Integrating meteorological data into volatility models enhances risk-hedging.

- The MSP system acts as implicit crop insurance, shielding farmers without premium payments.

- The study proposes a market-based risk-hedging mechanism where the government purchases insurance equivalent to MSP, estimated using the Black-Scholes model.

- Meteorological data's importance in agricultural risk modeling is underscored, supporting targeted insurance and strengthening resilience in agricultural finance.

Significance

This research is important as it highlights the need for a climate-informed financial framework to enhance risk-sharing, stabilize prices, and inform sustainable agricultural policy under growing climate uncertainty.

Technical Contribution

The integration of climate scenarios (SSP2.4.5 and SSP5.8.5) with risk models to predict and mitigate agricultural price volatility, along with the application of the Black-Scholes model to estimate the fiscal cost of the MSP system.

Novelty

The paper proposes a novel market-based risk-hedging mechanism using the government's purchase of insurance equivalent to MSP, estimated via the Black-Scholes model, distinguishing it from traditional approaches to agricultural risk management.

Limitations

- The study focuses on specific crops and regions in India, limiting its generalizability to other crops or geographies.

- Reliance on historical data may not fully capture future climate and market dynamics.

Future Work

- Expanding the analysis to more crops and regions for broader applicability.

- Incorporating machine learning techniques to improve predictive models and account for complex interactions between climate, market, and socio-economic factors.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Impact of Meteorological Factors on Crop Price Volatility in India: Case studies of Soybean and Brinjal

Ashok Kumar, Sourish Das, Anirban Chakraborti et al.

Combining Deep Learning and GARCH Models for Financial Volatility and Risk Forecasting

Łukasz Kwiatkowski, Jakub Michańków, Janusz Morajda

No citations found for this paper.

Comments (0)