Summary

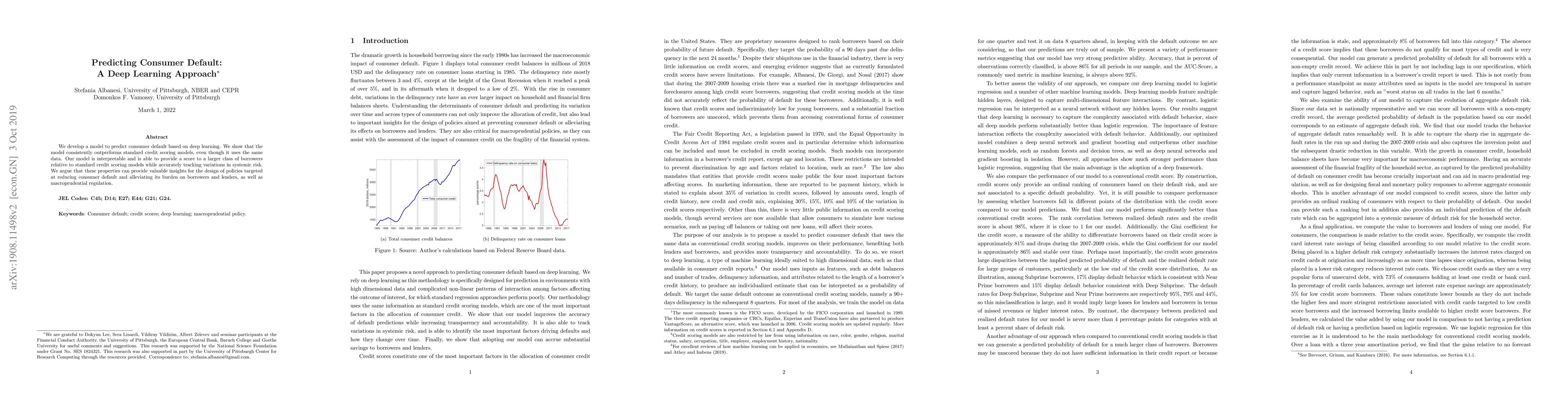

We develop a model to predict consumer default based on deep learning. We show that the model consistently outperforms standard credit scoring models, even though it uses the same data. Our model is interpretable and is able to provide a score to a larger class of borrowers relative to standard credit scoring models while accurately tracking variations in systemic risk. We argue that these properties can provide valuable insights for the design of policies targeted at reducing consumer default and alleviating its burden on borrowers and lenders, as well as macroprudential regulation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOffline Deep Reinforcement Learning for Dynamic Pricing of Consumer Credit

Raad Khraishi, Ramin Okhrati

\textsc{DeFault}: Deep-learning-based Fault Delineation

Hanchen Wang, Tariq Alkhalifah, Ting Chen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)