Summary

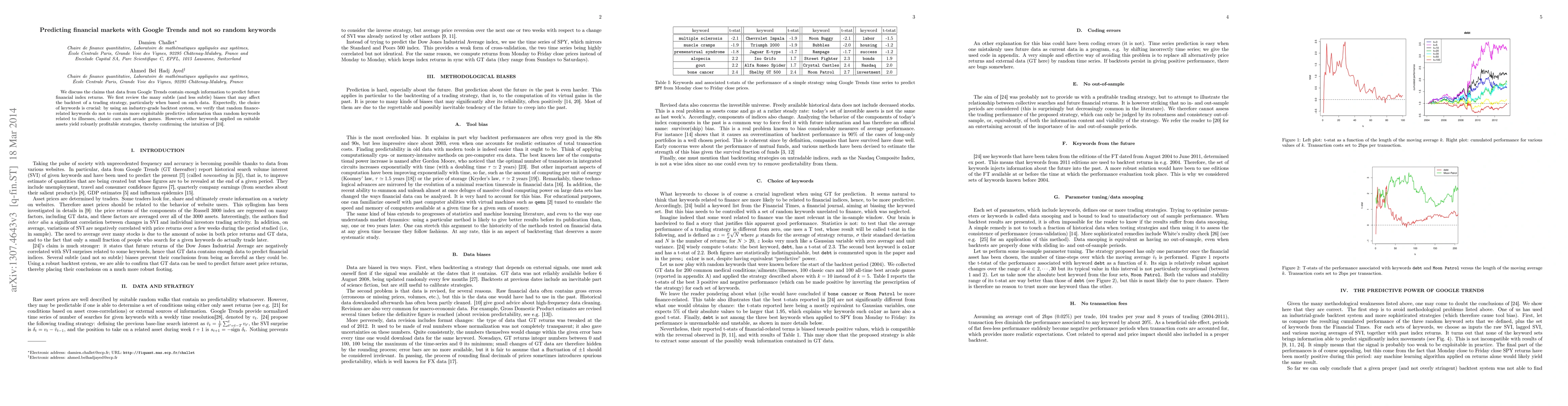

We check the claims that data from Google Trends contain enough data to predict future financial index returns. We first discuss the many subtle (and less subtle) biases that may affect the backtest of a trading strategy, particularly when based on such data. Expectedly, the choice of keywords is crucial: by using an industry-grade backtesting system, we verify that random finance-related keywords do not to contain more exploitable predictive information than random keywords related to illnesses, classic cars and arcade games. We however show that other keywords applied on suitable assets yield robustly profitable strategies, thereby confirming the intuition of Preis et al. (2013)

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredicting Tourism Demand in Indonesia Using Google Trends Data

Atika Nashirah Hasyyati, Rina Indriani, Titi Kanti Lestari

| Title | Authors | Year | Actions |

|---|

Comments (0)