Authors

Summary

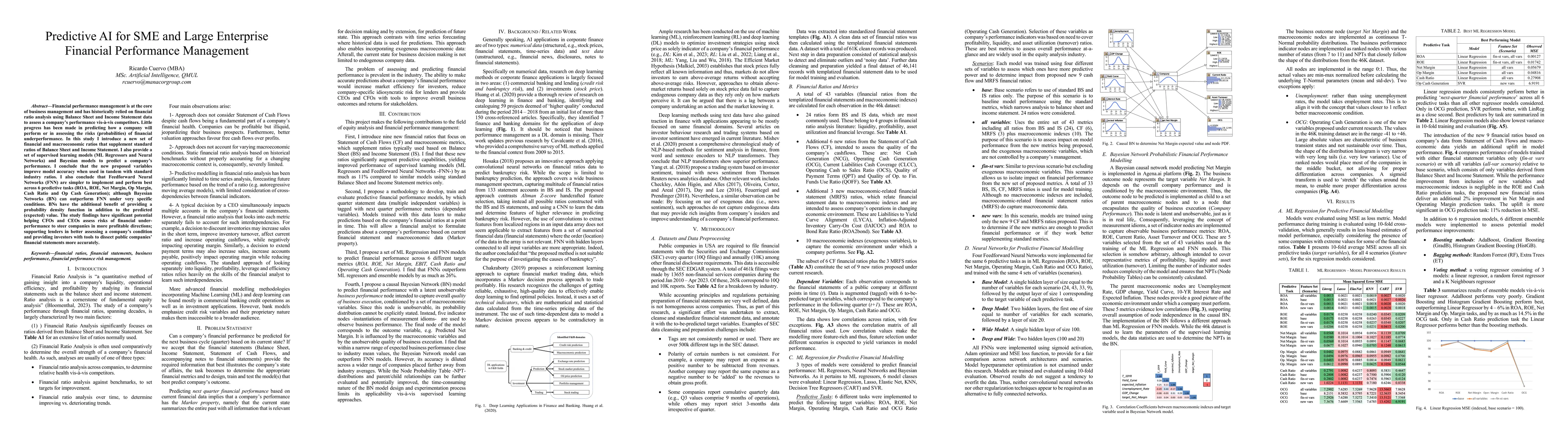

Financial performance management is at the core of business management and has historically relied on financial ratio analysis using Balance Sheet and Income Statement data to assess company performance as compared with competitors. Little progress has been made in predicting how a company will perform or in assessing the risks (probabilities) of financial underperformance. In this study I introduce a new set of financial and macroeconomic ratios that supplement standard ratios of Balance Sheet and Income Statement. I also provide a set of supervised learning models (ML Regressors and Neural Networks) and Bayesian models to predict company performance. I conclude that the new proposed variables improve model accuracy when used in tandem with standard industry ratios. I also conclude that Feedforward Neural Networks (FNN) are simpler to implement and perform best across 6 predictive tasks (ROA, ROE, Net Margin, Op Margin, Cash Ratio and Op Cash Generation); although Bayesian Networks (BN) can outperform FNN under very specific conditions. BNs have the additional benefit of providing a probability density function in addition to the predicted (expected) value. The study findings have significant potential helping CFOs and CEOs assess risks of financial underperformance to steer companies in more profitable directions; supporting lenders in better assessing the condition of a company and providing investors with tools to dissect financial statements of public companies more accurately.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModel Risk Management for Generative AI In Financial Institutions

Anwesha Bhattacharyya, Rahul Singh, Tarun Joshi et al.

Generative AI Enhanced Financial Risk Management Information Retrieval

Amin Haeri, Jonathan Vitrano, Mahdi Ghelichi

| Title | Authors | Year | Actions |

|---|

Comments (0)