Summary

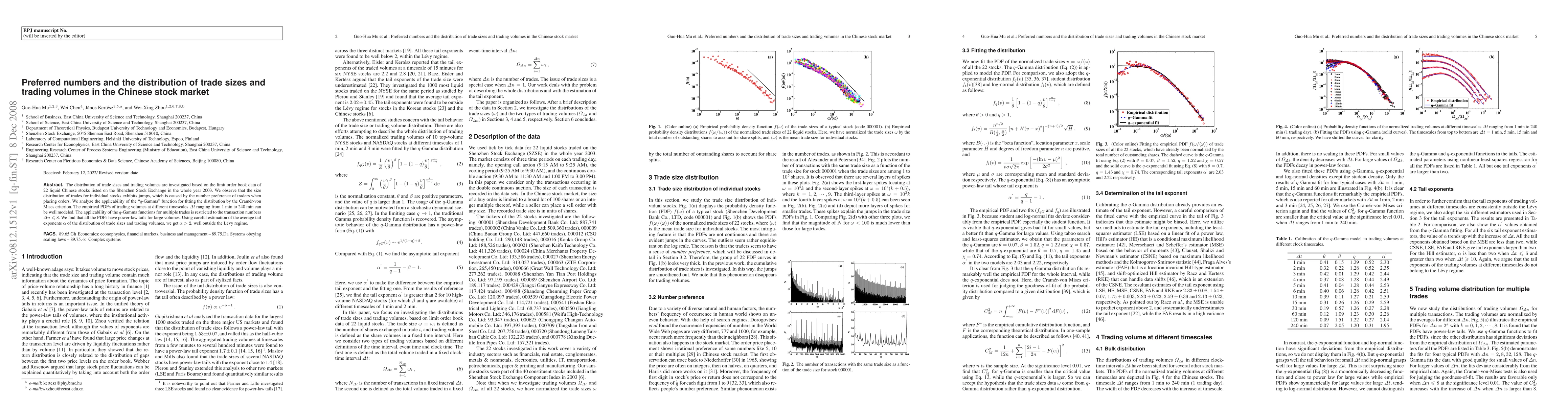

The distribution of trade sizes and trading volumes are investigated based on the limit order book data of 22 liquid Chinese stocks listed on the Shenzhen Stock Exchange in the whole year 2003. We observe that the size distribution of trades for individual stocks exhibits jumps, which is caused by the number preference of traders when placing orders. We analyze the applicability of the "$q$-Gamma" function for fitting the distribution by the Cram\'{e}r-von Mises criterion. The empirical PDFs of trading volumes at different timescales $\Delta{t}$ ranging from 1 min to 240 min can be well modeled. The applicability of the $q$-Gamma functions for multiple trades is restricted to the transaction numbers $\Delta{n}\leqslant8$. We find that all the PDFs have power-law tails for large volumes. Using careful estimation of the average tail exponents $\alpha$ of the distribution of trade sizes and trading volumes, we get $\alpha>2$, well outside the L{\'e}vy regime.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalyst Reports and Stock Performance: Evidence from the Chinese Market

Rui Liu, Yujia Hu, Jiayou Liang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)