Summary

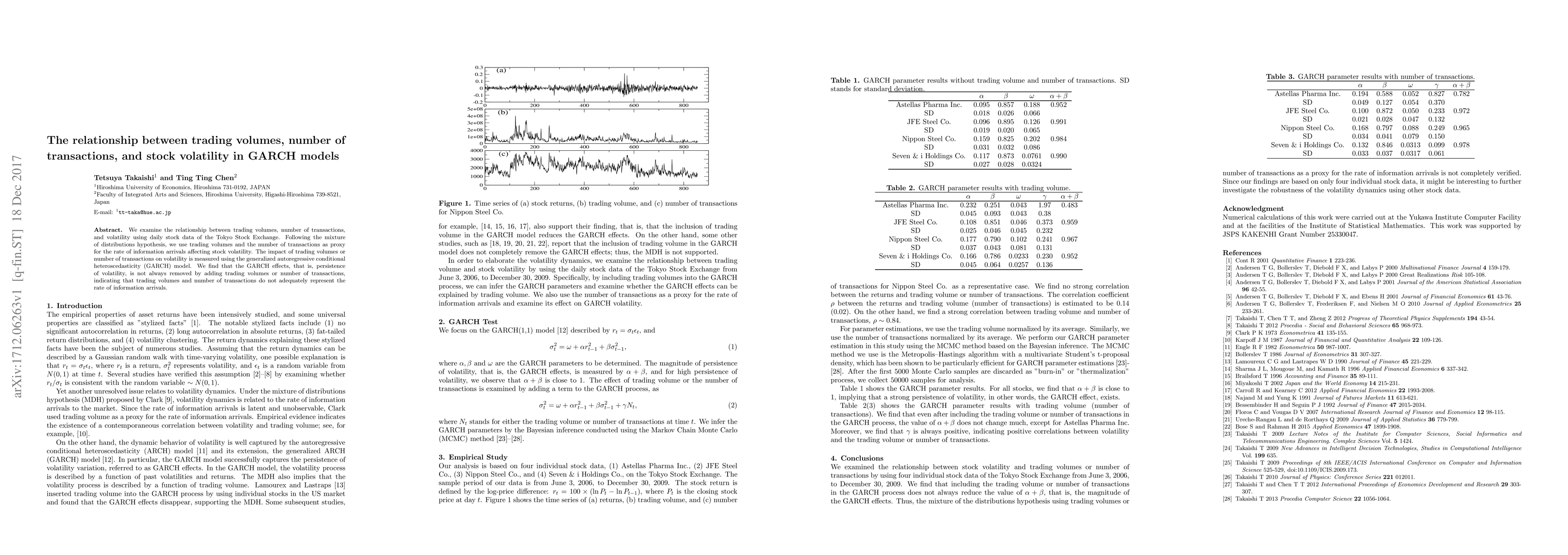

We examine the relationship between trading volumes, number of transactions, and volatility using daily stock data of the Tokyo Stock Exchange. Following the mixture of distributions hypothesis, we use trading volumes and the number of transactions as proxy for the rate of information arrivals affecting stock volatility. The impact of trading volumes or number of transactions on volatility is measured using the generalized autoregressive conditional heteroscedasticity (GARCH) model. We find that the GARCH effects, that is, persistence of volatility, is not always removed by adding trading volumes or number of transactions, indicating that trading volumes and number of transactions do not adequately represent the rate of information arrivals.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)