Authors

Summary

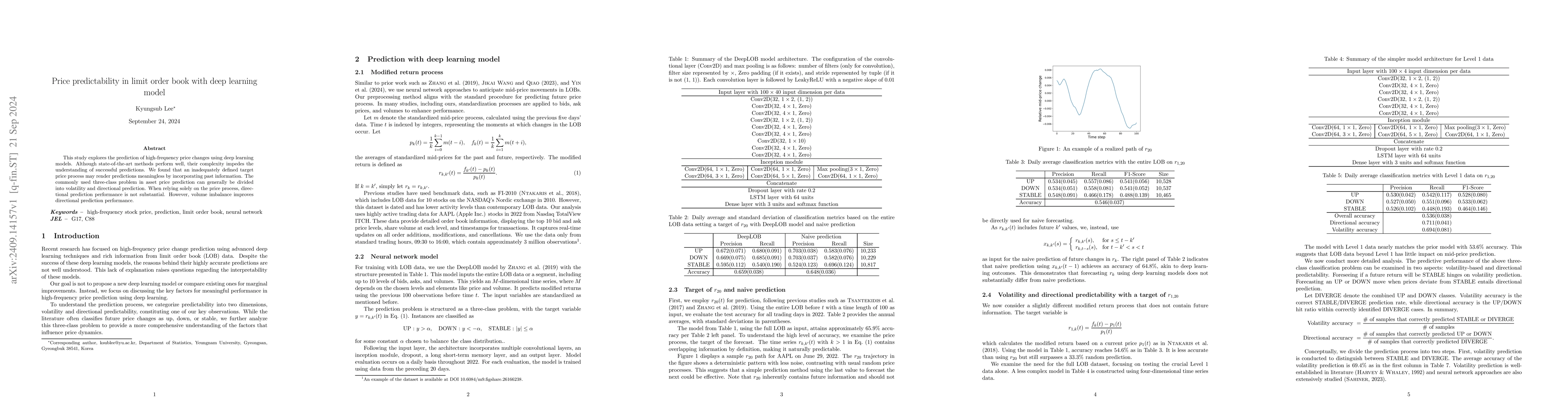

This study explores the prediction of high-frequency price changes using deep learning models. Although state-of-the-art methods perform well, their complexity impedes the understanding of successful predictions. We found that an inadequately defined target price process may render predictions meaningless by incorporating past information. The commonly used three-class problem in asset price prediction can generally be divided into volatility and directional prediction. When relying solely on the price process, directional prediction performance is not substantial. However, volume imbalance improves directional prediction performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Limit Order Book Forecasting

Antonio Briola, Silvia Bartolucci, Tomaso Aste

The Short-Term Predictability of Returns in Order Book Markets: a Deep Learning Perspective

Lorenzo Lucchese, Mikko Pakkanen, Almut Veraart

Deep limit order book forecasting: a microstructural guide.

Briola, Antonio, Bartolucci, Silvia, Aste, Tomaso

No citations found for this paper.

Comments (0)