Summary

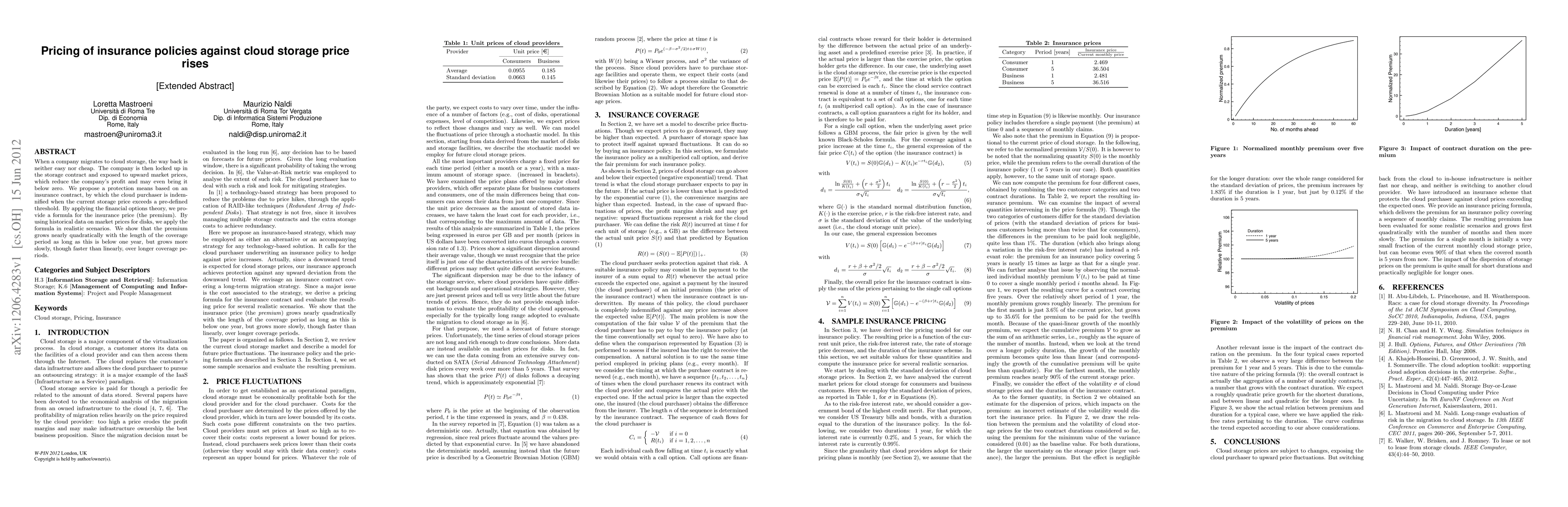

When a company migrates to cloud storage, the way back is neither easy nor cheap. The company is then locked up in the storage contract and exposed to upward market prices, which reduce the company's profit and may even bring it below zero. We propose a protection means based on an insurance contract, by which the cloud purchaser is indemnified when the current storage price exceeds a pre-defined threshold. By applying the financial options theory, we provide a formula for the insurance price (the premium). By using historical data on market prices for disks, we apply the formula in realistic scenarios. We show that the premium grows nearly quadratically with the length of the coverage period as long as this is below one year, but grows more slowly, though faster than linearly, over longer coverage periods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInsurance pricing on price comparison websites via reinforcement learning

Yufei Zhang, Lukasz Szpruch, Tanut Treetanthiploet et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)