Summary

The emergence of price comparison websites (PCWs) has presented insurers with unique challenges in formulating effective pricing strategies. Operating on PCWs requires insurers to strike a delicate balance between competitive premiums and profitability, amidst obstacles such as low historical conversion rates, limited visibility of competitors' actions, and a dynamic market environment. In addition to this, the capital intensive nature of the business means pricing below the risk levels of customers can result in solvency issues for the insurer. To address these challenges, this paper introduces reinforcement learning (RL) framework that learns the optimal pricing policy by integrating model-based and model-free methods. The model-based component is used to train agents in an offline setting, avoiding cold-start issues, while model-free algorithms are then employed in a contextual bandit (CB) manner to dynamically update the pricing policy to maximise the expected revenue. This facilitates quick adaptation to evolving market dynamics and enhances algorithm efficiency and decision interpretability. The paper also highlights the importance of evaluating pricing policies using an offline dataset in a consistent fashion and demonstrates the superiority of the proposed methodology over existing off-the-shelf RL/CB approaches. We validate our methodology using synthetic data, generated to reflect private commercially available data within real-world insurers, and compare against 6 other benchmark approaches. Our hybrid agent outperforms these benchmarks in terms of sample efficiency and cumulative reward with the exception of an agent that has access to perfect market information which would not be available in a real-world set-up.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

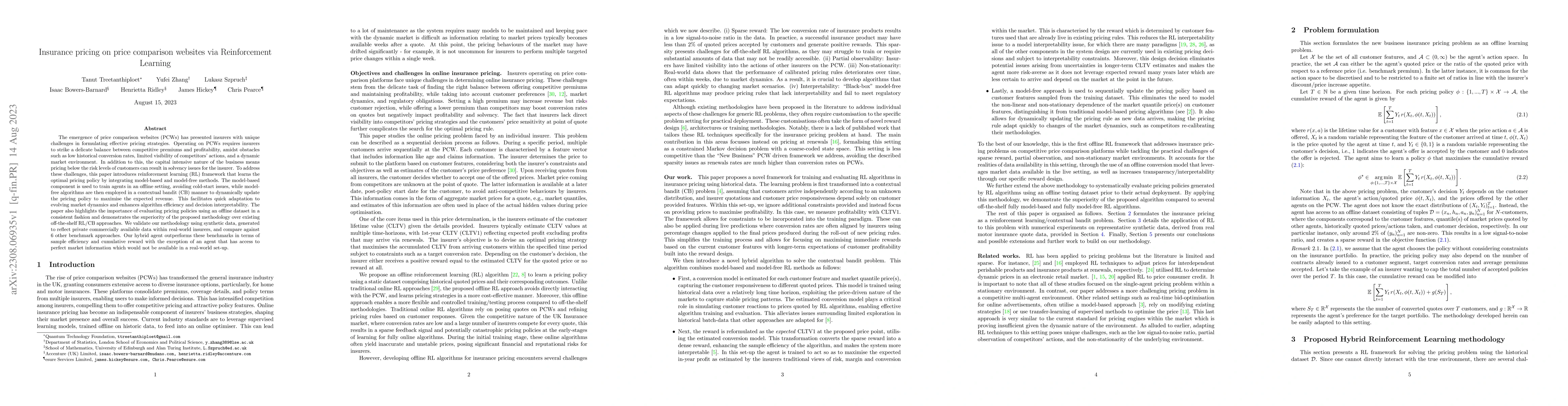

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)