Authors

Summary

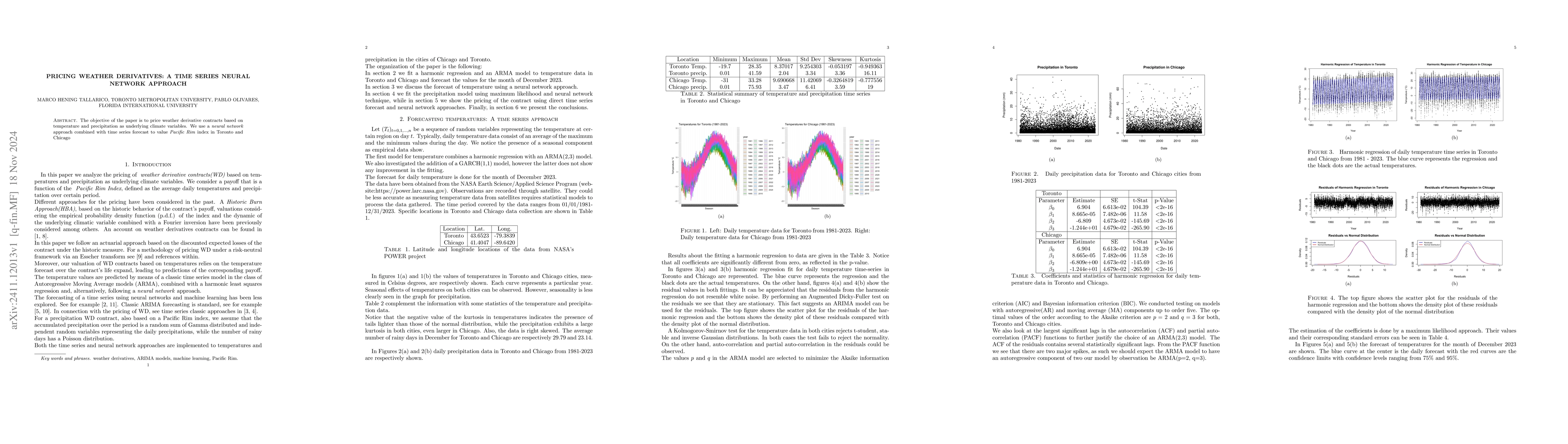

The objective of the paper is to price weather derivative contracts based on temperature and precipitation as underlying climate variables. We use a neural network approach combined with time series forecast to value Pacific Rim index in Toronto and Chicago

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Path Integral Approach for Time-Dependent Hamiltonians with Applications to Derivatives Pricing

Luca Capriotti, Mark Stedman

No citations found for this paper.

Comments (0)