Summary

Everlasting options, a relatively new class of perpetual financial derivatives, have emerged to tackle the challenges of rolling contracts and liquidity fragmentation in decentralized finance markets. This paper offers an in-depth analysis of markets for everlasting options, modeled using a dynamic proactive market maker. We examine the behavior of funding fees and transaction costs across varying liquidity conditions. Using simulations and modeling, we demonstrate that liquidity providers can aim to achieve a net positive PnL by employing effective hedging strategies, even in challenging environments characterized by low liquidity and high transaction costs. Additionally, we provide insights into the incentives that drive liquidity providers to support the growth of everlasting option markets and highlight the significant benefits these instruments offer to traders as a reliable and efficient financial tool.

AI Key Findings

Generated Sep 03, 2025

Methodology

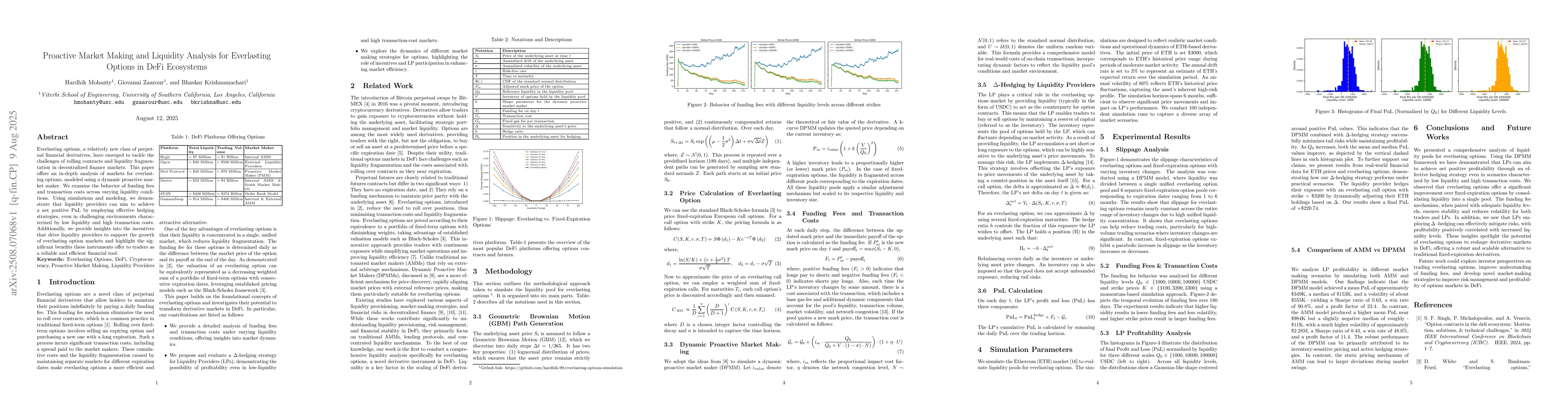

The methodology involves simulating the liquidity pool for everlasting options using a Dynamic Proactive Market Maker (DPMM) framework. It includes generating Geometric Brownian Motion (GBM) paths for underlying asset prices, calculating option prices using Black-Scholes formula for fixed-expiration options and approximating everlasting options with a weighted sum of fixed-expiration calls. The DPMM updates quoted prices based on current inventory, and funding fees and transaction costs are calculated daily.

Key Results

- Everlasting options exhibit nearly constant slippage across varying inventory changes, reducing trading costs compared to fixed-expiration options.

- Higher liquidity results in lower funding fees and less volatility, while higher strike prices lead to larger funding fees.

- Liquidity providers (LPs) using ∆-hedging strategies achieve positive PnL with minimal tail risks, and their profitability improves with increased liquidity levels.

- The DPMM model outperforms the Automated Market Maker (AMM) model in terms of mean PnL, median PnL, volatility, Sharpe ratio, win rate, and profit factor.

- Everlasting options offer significant improvements over fixed-expiration options by consolidating liquidity into a single pool, ensuring stability, and reducing volatility for traders and LPs.

Significance

This research is important as it demonstrates the potential of everlasting options to reshape derivative markets in DeFi, offering a robust and scalable alternative to traditional fixed-expiration derivatives. It highlights the benefits of employing effective hedging strategies for liquidity providers, even in low-liquidity, high-transaction-cost environments.

Technical Contribution

The paper introduces a comprehensive liquidity analysis for everlasting options using a Dynamic Proactive Market Maker (DPMM) framework, which efficiently aligns market prices with external reference prices and effectively manages inventory-sensitive pricing and active hedging strategies.

Novelty

This work is the first to conduct a comprehensive liquidity analysis specifically for everlasting options, a novel derivative instrument in DeFi, distinguishing it from existing studies focusing on traditional AMMs, lending protocols, and concentrated liquidity mechanisms.

Limitations

- The study is limited to the Ethereum (ETH) market and may not generalize to other DeFi ecosystems.

- The simulation results are based on historical price data and may not fully capture future market dynamics.

Future Work

- Investigating investor perspectives on trading everlasting options.

- Improving understanding of funding fees and developing novel market-making strategies to enhance risk management and profitability in DeFi options markets.

Paper Details

PDF Preview

Similar Papers

Found 4 papersZeroSwap: Data-driven Optimal Market Making in DeFi

Viraj Nadkarni, Chi Jin, Sanjeev Kulkarni et al.

Comments (0)