Authors

Summary

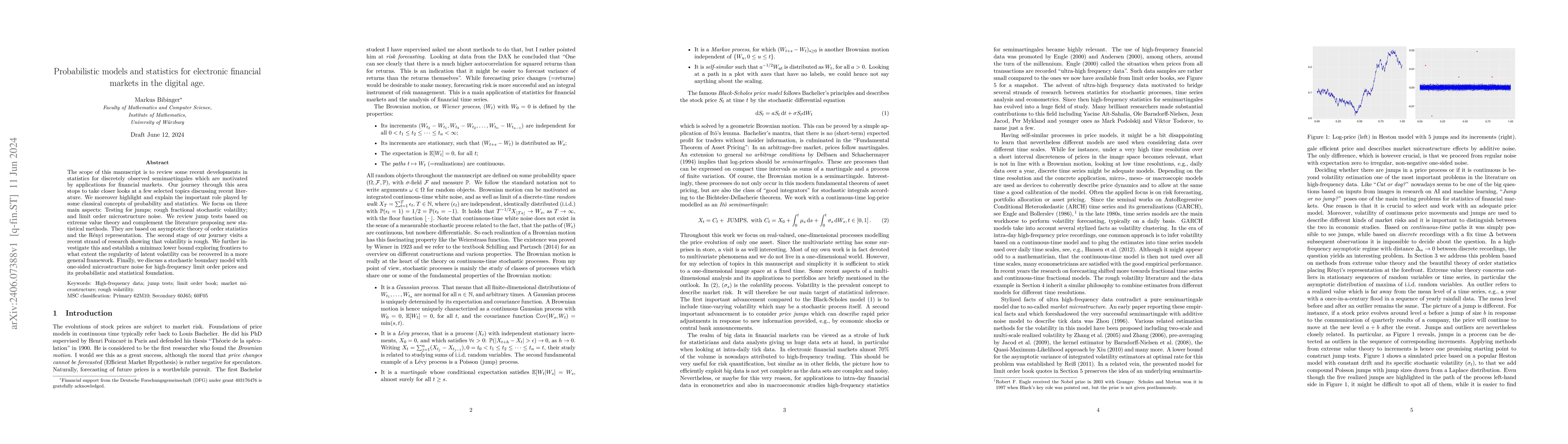

The scope of this manuscript is to review some recent developments in statistics for discretely observed semimartingales which are motivated by applications for financial markets. Our journey through this area stops to take closer looks at a few selected topics discussing recent literature. We moreover highlight and explain the important role played by some classical concepts of probability and statistics. We focus on three main aspects: Testing for jumps; rough fractional stochastic volatility; and limit order microstructure noise. We review jump tests based on extreme value theory and complement the literature proposing new statistical methods. They are based on asymptotic theory of order statistics and the R\'{e}nyi representation. The second stage of our journey visits a recent strand of research showing that volatility is rough. We further investigate this and establish a minimax lower bound exploring frontiers to what extent the regularity of latent volatility can be recovered in a more general framework. Finally, we discuss a stochastic boundary model with one-sided microstructure noise for high-frequency limit order prices and its probabilistic and statistical foundation.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper reviews recent developments in statistical methods for discretely observed semimartingales, focusing on three main aspects: testing for jumps, rough fractional stochastic volatility, and limit order microstructure noise. It employs classical probability and statistical concepts, introducing new statistical methods based on asymptotic theory of order statistics and the Rényi representation.

Key Results

- New statistical methods for jump tests based on extreme value theory and Rényi representation.

- Establishment of a minimax lower bound for recovering latent volatility regularity in a more general framework.

- Development of a stochastic boundary model with one-sided microstructure noise for high-frequency limit order prices and its probabilistic and statistical foundation.

Significance

This research is significant as it contributes to the advancement of statistical methods for financial market analysis in the digital age, offering new approaches to testing for jumps, modeling rough fractional stochastic volatility, and understanding limit order microstructure noise.

Technical Contribution

The paper's main technical contribution lies in the introduction of new statistical methods for jump detection and the establishment of a minimax lower bound for volatility regularity recovery, grounded in asymptotic theory of order statistics and the Rényi representation.

Novelty

This work stands out by combining classical probability and statistical concepts with modern developments in financial econometrics, proposing novel statistical methods for jump testing and volatility modeling, and providing a theoretical foundation for understanding microstructure noise in high-frequency limit order books.

Limitations

- The paper does not provide extensive empirical validation of the proposed methods.

- The focus on theoretical contributions may limit the immediate applicability to practical financial market problems.

Future Work

- Further empirical studies to validate the proposed statistical methods in real-world financial datasets.

- Exploration of additional applications of the developed methods in other areas of financial econometrics.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCentral Bank Digital Currency: The Advent of its IT Governance in the financial markets

Carlos Alberto Durigan Junior, Mauro De Mesquita Spinola, Rodrigo Franco Gonçalves et al.

No citations found for this paper.

Comments (0)