Authors

Summary

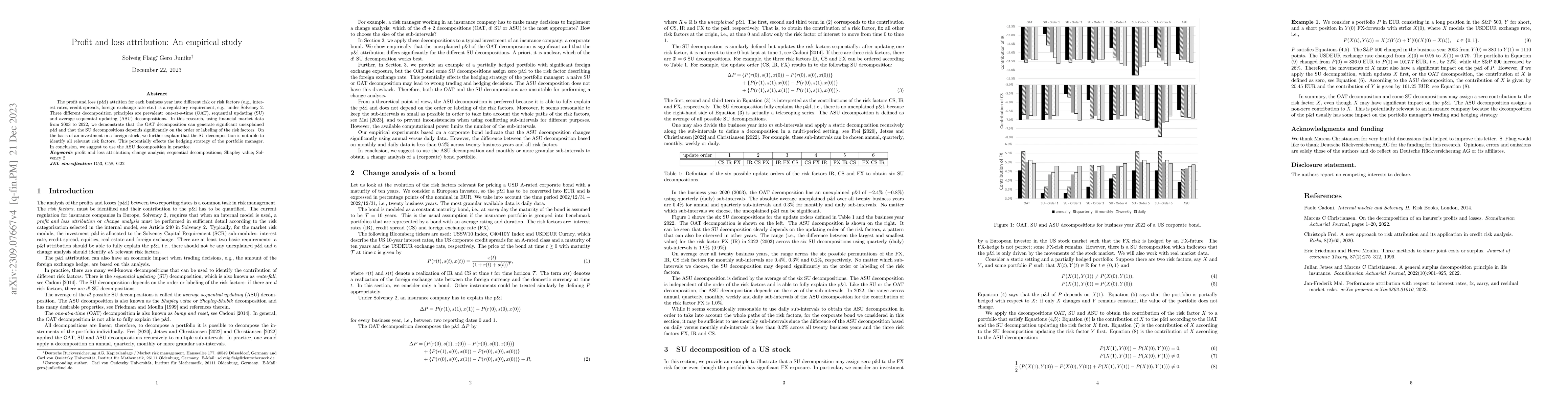

The profit and loss (p&l) attrition for each business year into different risk or risk factors (e.g., interest rates, credit spreads, foreign exchange rate etc.) is a regulatory requirement, e.g., under Solvency 2. Three different decomposition principles are prevalent: one-at-a-time (OAT), sequential updating (SU) and average sequential updating (ASU) decompositions. In this research, using financial market data from 2003 to 2022, we demonstrate that the OAT decomposition can generate significant unexplained p&l and that the SU decompositions depends significantly on the order or labeling of the risk factors. On the basis of an investment in a foreign stock, we further explain that the SU decomposition is not able to identify all relevant risk factors. This potentially effects the hedging strategy of the portfolio manager. In conclusion, we suggest to use the ASU decomposition in practice.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)