Authors

Summary

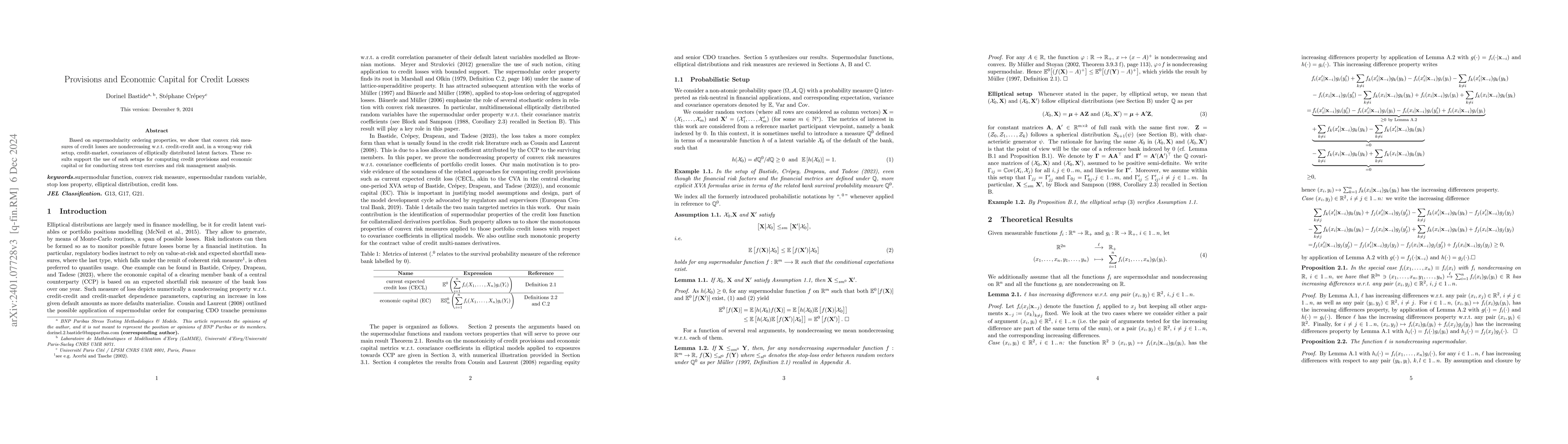

Based on supermodularity ordering properties, we show that convex risk measures of credit losses are nondecreasing w.r.t. credit-credit and, in a wrong-way risk setup, credit-market, covariances of elliptically distributed latent factors. These results support the use of such setups for computing credit provisions and economic capital or for conducting stress test exercises and risk management analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)