Summary

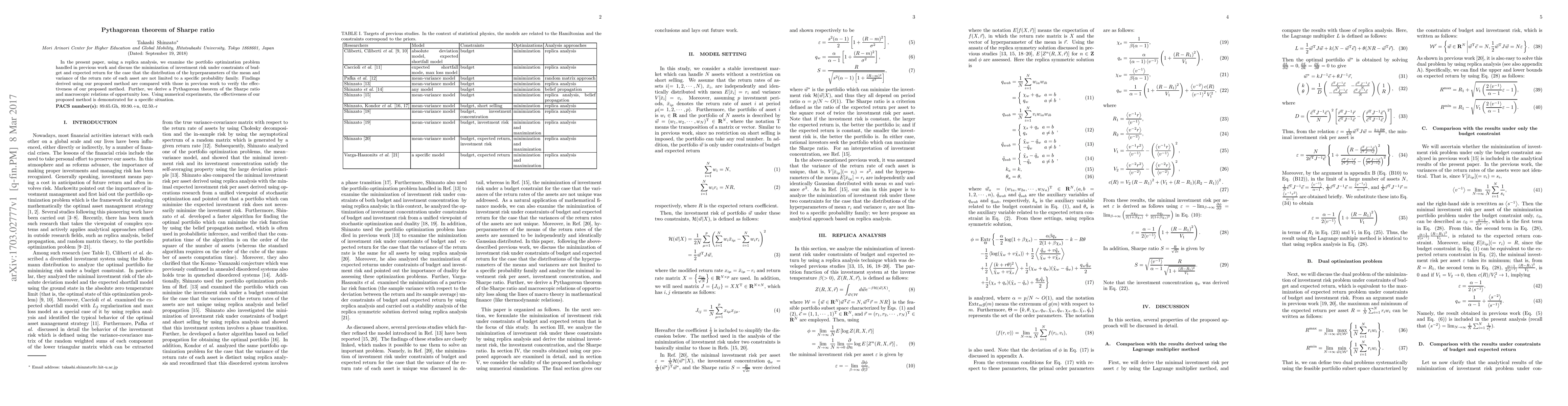

In the present paper, using a replica analysis, we examine the portfolio optimization problem handled in previous work and discuss the minimization of investment risk under constraints of budget and expected return for the case that the distribution of the hyperparameters of the mean and variance of the return rate of each asset are not limited to a specific probability family. Findings derived using our proposed method are compared with those in previous work to verify the effectiveness of our proposed method. Further, we derive a Pythagorean theorem of the Sharpe ratio and macroscopic relations of opportunity loss. Using numerical experiments, the effectiveness of our proposed method is demonstrated for a specific situation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)