Summary

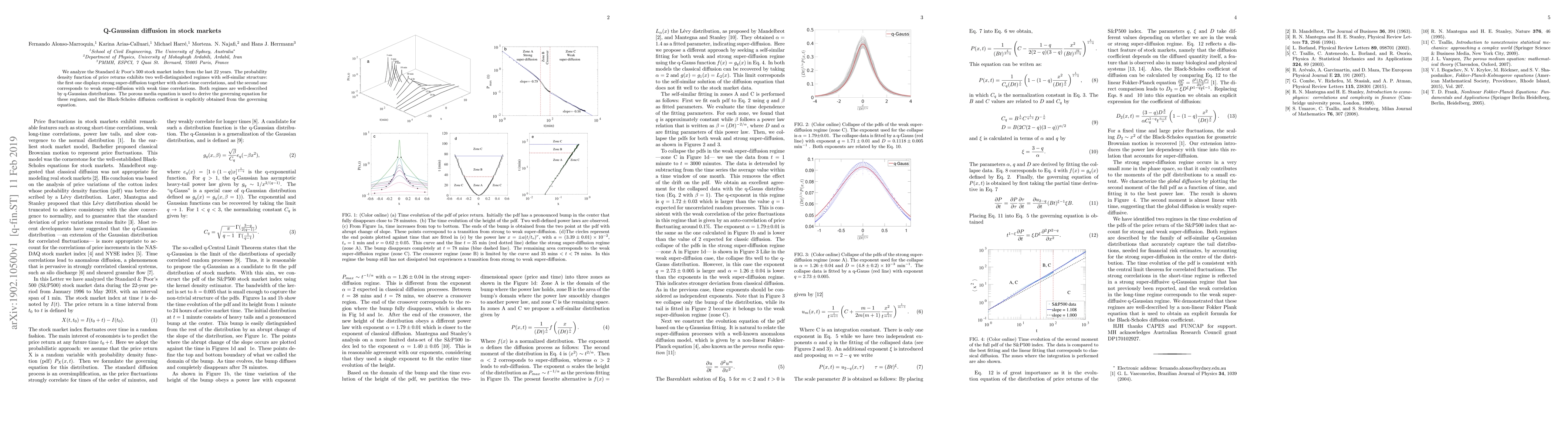

We analyze the Standard & Poor's 500 stock market index from the last 22 years. The probability density function of price returns exhibits two well-distinguished regimes with self-similar structure: the first one displays strong super-diffusion together with short-time correlations, and the second one corresponds to weak super-diffusion with weak time correlations. Both regimes are well-described by q-Gaussian distributions. The porous media equation is used to derive the governing equation for these regimes, and the Black-Scholes diffusion coefficient is explicitly obtained from the governing equation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)