Authors

Summary

This work introduces a framework for evaluating onchain order flow auctions (OFAs), emphasizing the metric of price improvement. Utilizing a set of open-source tools, our methodology systematically attributes price improvements to specific modifiable inputs of the system such as routing efficiency, gas optimization, and priority fee settings. When applied to leading Ethereum-based trading interfaces such as 1Inch and Uniswap, the results reveal that auction-enhanced interfaces can provide statistically significant improvements in trading outcomes, averaging 4-5 basis points in our sample. We further identify the sources of such price improvements to be added liquidity for large swaps. This research lays a foundation for future innovations in blockchain based trading platforms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

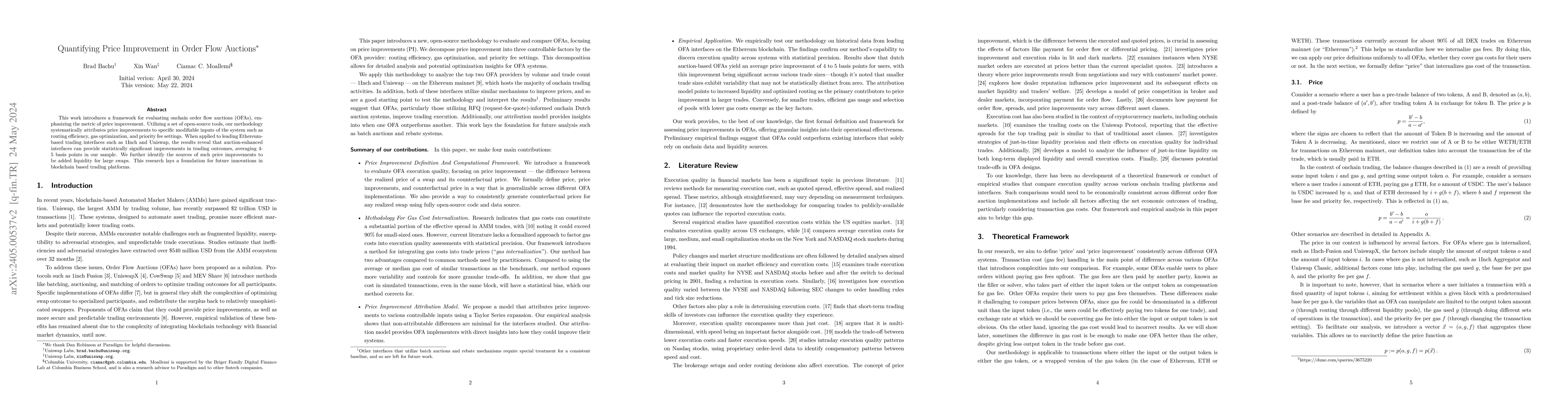

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrice Manipulability in First-Price Auctions

Paul Dütting, Balasubramanian Sivan, Johannes Brustle

| Title | Authors | Year | Actions |

|---|

Comments (0)