Summary

This paper proposes two numerical solution based on Product Optimal Quantization for the pricing of Foreign Echange (FX) linked long term Bermudan options e.g. Bermudan Power Reverse Dual Currency options, where we take into account stochastic domestic and foreign interest rates on top of stochastic FX rate, hence we consider a 3-factor model. For these two numerical methods, we give an estimation of the $L^2$-error induced by such approximations and we illustrate them with market-based examples that highlight the speed of such methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

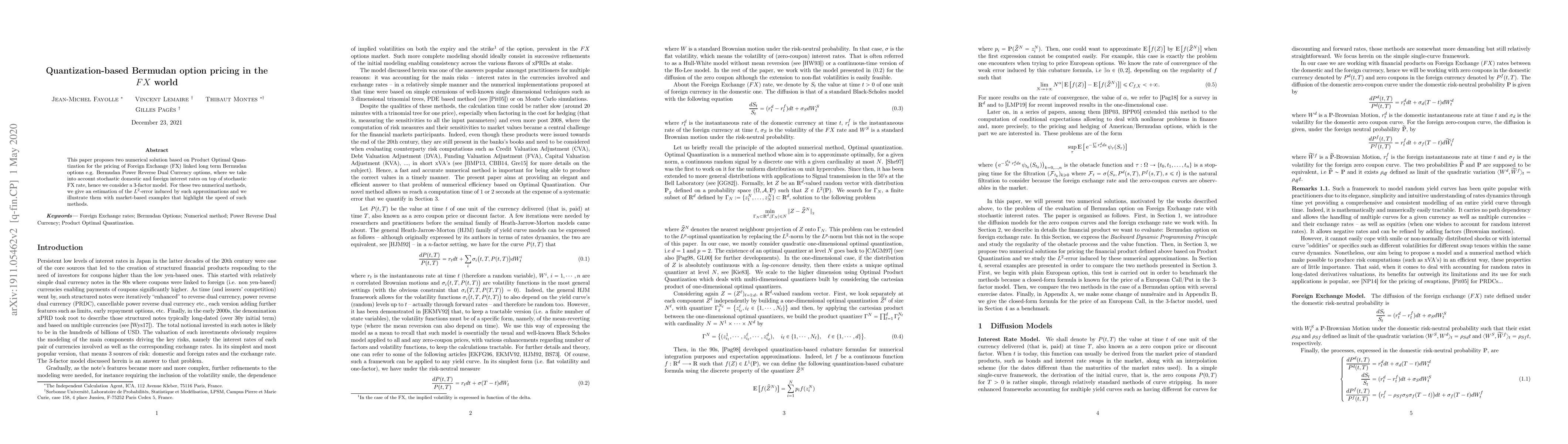

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)