Summary

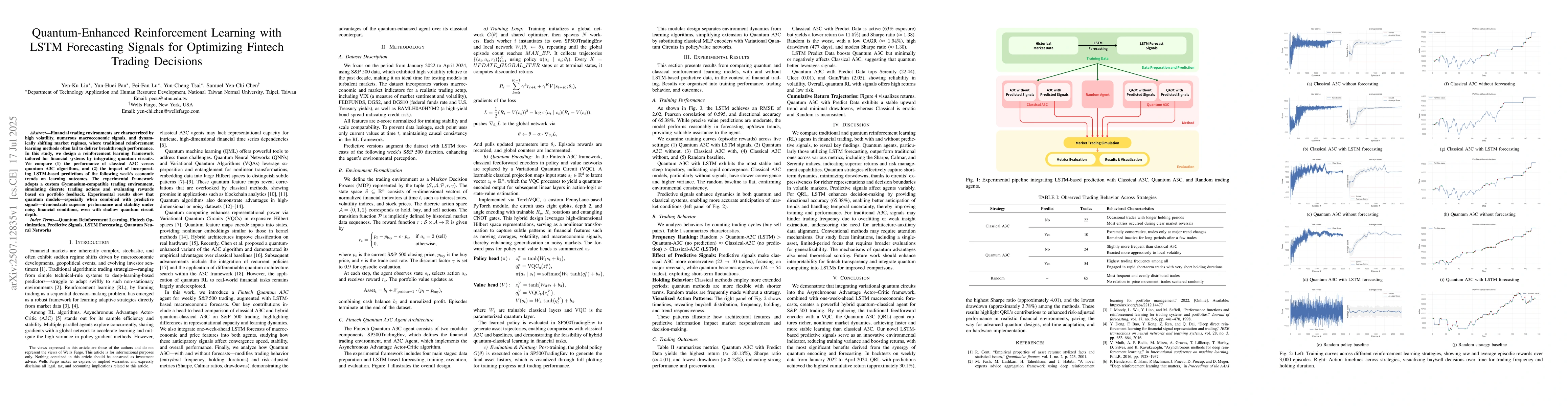

Financial trading environments are characterized by high volatility, numerous macroeconomic signals, and dynamically shifting market regimes, where traditional reinforcement learning methods often fail to deliver breakthrough performance. In this study, we design a reinforcement learning framework tailored for financial systems by integrating quantum circuits. We compare (1) the performance of classical A3C versus quantum A3C algorithms, and (2) the impact of incorporating LSTM-based predictions of the following week's economic trends on learning outcomes. The experimental framework adopts a custom Gymnasium-compatible trading environment, simulating discrete trading actions and evaluating rewards based on portfolio feedback. Experimental results show that quantum models - especially when combined with predictive signals - demonstrate superior performance and stability under noisy financial conditions, even with shallow quantum circuit depth.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Novel Deep Reinforcement Learning Based Automated Stock Trading System Using Cascaded LSTM Networks

Jie Zou, Jiashu Lou, Baohua Wang et al.

Combining Deep Learning on Order Books with Reinforcement Learning for Profitable Trading

Koti S. Jaddu, Paul A. Bilokon

Optimizing Stock Option Forecasting with the Assembly of Machine Learning Models and Improved Trading Strategies

Zheng Cao, Wenyu Du, Raymond Guo et al.

No citations found for this paper.

Comments (0)