Summary

The convergence of quantum-inspired neural networks and deep reinforcement learning offers a promising avenue for financial trading. We implemented a trading agent for USD/TWD by integrating Quantum Long Short-Term Memory (QLSTM) for short-term trend prediction with Quantum Asynchronous Advantage Actor-Critic (QA3C), a quantum-enhanced variant of the classical A3C. Trained on data from 2000-01-01 to 2025-04-30 (80\% training, 20\% testing), the long-only agent achieves 11.87\% return over around 5 years with 0.92\% max drawdown, outperforming several currency ETFs. We detail state design (QLSTM features and indicators), reward function for trend-following/risk control, and multi-core training. Results show hybrid models yield competitive FX trading performance. Implications include QLSTM's effectiveness for small-profit trades with tight risk and future enhancements. Key hyperparameters: QLSTM sequence length$=$4, QA3C workers$=$8. Limitations: classical quantum simulation and simplified strategy. \footnote{The views expressed in this article are those of the authors and do not represent the views of Wells Fargo. This article is for informational purposes only. Nothing contained in this article should be construed as investment advice. Wells Fargo makes no express or implied warranties and expressly disclaims all legal, tax, and accounting implications related to this article.

AI Key Findings

Generated Nov 01, 2025

Methodology

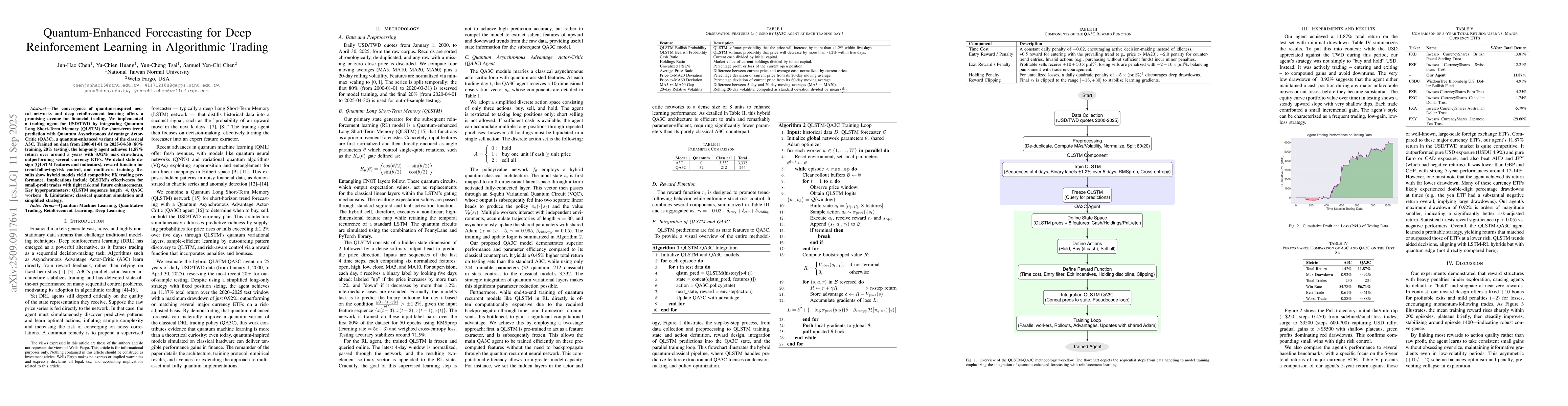

The research integrates Quantum Long Short-Term Memory (QLSTM) for trend forecasting with Quantum Asynchronous Advantage Actor-Critic (QA3C) for decision-making, combining quantum computing principles with reinforcement learning algorithms to develop a hybrid trading agent.

Key Results

- The QLSTM-QA3C agent achieved a 11.87% total return with a 0.92% maximum drawdown on USD/TWD data from 2000-2025.

- The agent outperformed or matched major currency ETFs in risk-adjusted returns while executing 231 disciplined trades.

- The domain-specific reward function balanced time decay penalties, asymmetric profit bonuses, and quadratic loss punishments, fostering a high-win-rate, low-volatility strategy.

Significance

This research demonstrates the practical value of quantum-inspired models in financial applications, bridging theoretical quantum machine learning with real-world trading scenarios and opening new possibilities for algorithmic trading and risk management.

Technical Contribution

The work contributes to quantum machine learning literature by demonstrating quantum RNNs in finance and proposes future end-to-end quantum reinforcement learning approaches using variational quantum circuits.

Novelty

This study introduces a novel hybrid trading agent combining QLSTM for trend forecasting with QA3C for decision-making, leveraging quantum computing's potential to model complex financial time series dependencies.

Limitations

- The strategy is long-only and lacks transaction cost modeling.

- Real-time adaptation capabilities are limited.

Future Work

- Exploring bidirectional trading strategies.

- Deploying quantum hardware for enhanced performance.

- Integrating transaction cost models and real-time adaptation mechanisms.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDeep Reinforcement Learning for Quantitative Trading

Jiawei Du, Zheng Tao, Zixun Lan et al.

Comments (0)