Summary

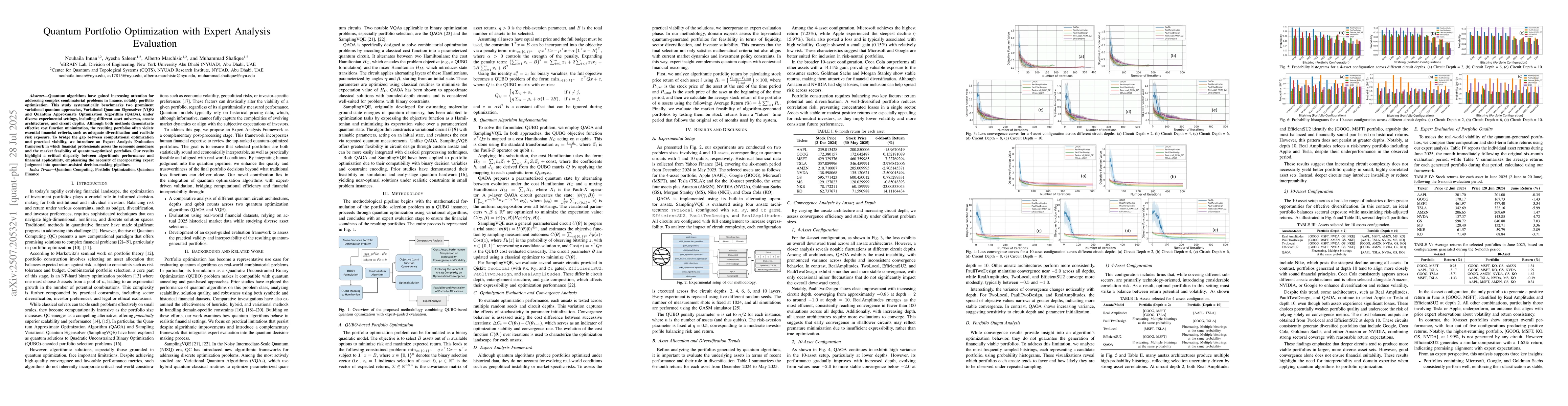

Quantum algorithms have gained increasing attention for addressing complex combinatorial problems in finance, notably portfolio optimization. This study systematically benchmarks two prominent variational quantum approaches, Variational Quantum Eigensolver (VQE) and Quantum Approximate Optimization Algorithm (QAOA), under diverse experimental settings, including different asset universes, ansatz architectures, and circuit depths. Although both methods demonstrate effective cost function minimization, the resulting portfolios often violate essential financial criteria, such as adequate diversification and realistic risk exposure. To bridge the gap between computational optimization and practical viability, we introduce an Expert Analysis Evaluation framework in which financial professionals assess the economic soundness and the market feasibility of quantum-optimized portfolios. Our results highlight a critical disparity between algorithmic performance and financial applicability, emphasizing the necessity of incorporating expert judgment into quantum-assisted decision-making pipelines.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnd-to-End Portfolio Optimization with Quantum Annealing

Kazuki Ikeda, Sai Nandan Morapakula, Sangram Deshpande et al.

Comparing Classical-Quantum Portfolio Optimization with Enhanced Constraints

Salvatore Certo, Daniel Beaulieu, Anh Dung Pham

A Quantum Online Portfolio Optimization Algorithm

Patrick Rebentrost, Debbie Lim

No citations found for this paper.

Comments (0)