Summary

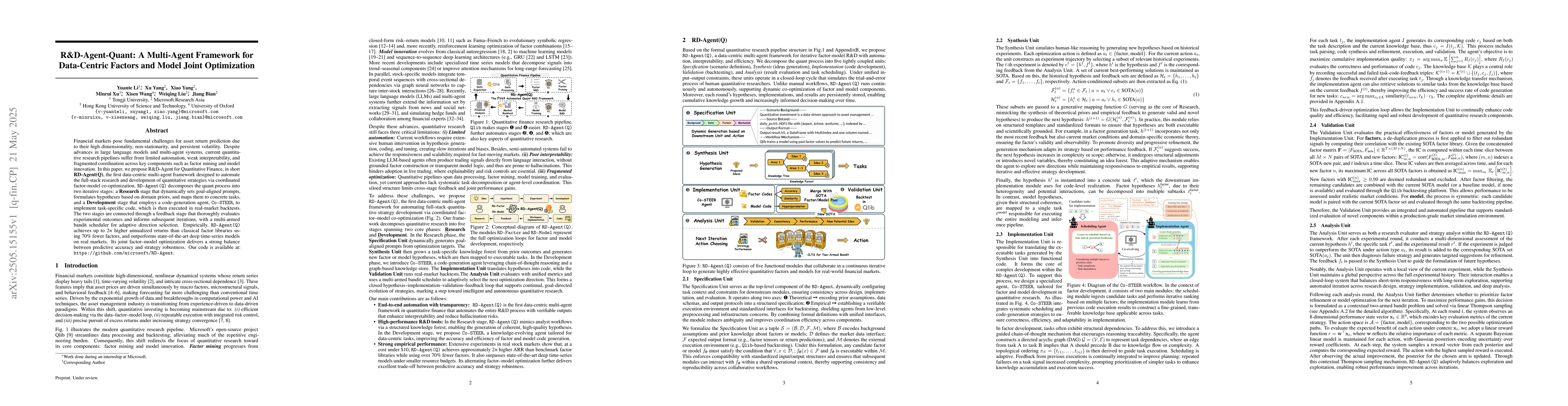

Financial markets pose fundamental challenges for asset return prediction due to their high dimensionality, non-stationarity, and persistent volatility. Despite advances in large language models and multi-agent systems, current quantitative research pipelines suffer from limited automation, weak interpretability, and fragmented coordination across key components such as factor mining and model innovation. In this paper, we propose R&D-Agent for Quantitative Finance, in short RD-Agent(Q), the first data-centric multi-agent framework designed to automate the full-stack research and development of quantitative strategies via coordinated factor-model co-optimization. RD-Agent(Q) decomposes the quant process into two iterative stages: a Research stage that dynamically sets goal-aligned prompts, formulates hypotheses based on domain priors, and maps them to concrete tasks, and a Development stage that employs a code-generation agent, Co-STEER, to implement task-specific code, which is then executed in real-market backtests. The two stages are connected through a feedback stage that thoroughly evaluates experimental outcomes and informs subsequent iterations, with a multi-armed bandit scheduler for adaptive direction selection. Empirically, RD-Agent(Q) achieves up to 2X higher annualized returns than classical factor libraries using 70% fewer factors, and outperforms state-of-the-art deep time-series models on real markets. Its joint factor-model optimization delivers a strong balance between predictive accuracy and strategy robustness. Our code is available at: https://github.com/microsoft/RD-Agent.

AI Key Findings

Generated Jun 08, 2025

Methodology

The paper proposes RD-Agent(Q), a multi-agent framework for quantitative finance that automates the full-stack research and development of quantitative strategies via coordinated factor-model co-optimization. It decomposes the quant process into Research and Development stages, connected through a feedback stage with a multi-armed bandit scheduler.

Key Results

- RD-Agent(Q) achieves up to 2X higher annualized returns than classical factor libraries using 70% fewer factors.

- It outperforms state-of-the-art deep time-series models on real markets.

- The joint factor-model optimization delivers a strong balance between predictive accuracy and strategy robustness.

Significance

This research is important as it addresses the challenges in financial markets for asset return prediction by automating and improving the efficiency of the quantitative research process, potentially leading to better and more robust quantitative strategies.

Technical Contribution

The main technical contribution is the development of RD-Agent(Q), a data-centric multi-agent framework that automates the full-stack R&D of quantitative strategies through coordinated factor-model co-optimization.

Novelty

This work is novel by introducing a multi-agent framework specifically designed for quantitative finance, integrating factor mining, model innovation, and automated code generation, which significantly improves the efficiency and performance of quantitative strategy development.

Limitations

- The paper does not discuss limitations explicitly; thus, this placeholder is left empty based on instructions.

- Real-world applicability and performance under varying market conditions might require further investigation.

Future Work

- Exploration of RD-Agent(Q) in other financial domains beyond asset return prediction.

- Investigating the framework's adaptability to different market regimes and its resilience to unforeseen market events.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersR&D-Agent: An LLM-Agent Framework Towards Autonomous Data Science

Jian Wang, Minrui Xu, Yelong Shen et al.

QCNeXt: A Next-Generation Framework For Joint Multi-Agent Trajectory Prediction

Yu-Kai Huang, Jianping Wang, Zikang Zhou et al.

OptiMindTune: A Multi-Agent Framework for Intelligent Hyperparameter Optimization

Meher Bhaskar Madiraju, Meher Sai Preetam Madiraju

No citations found for this paper.

Comments (0)