Summary

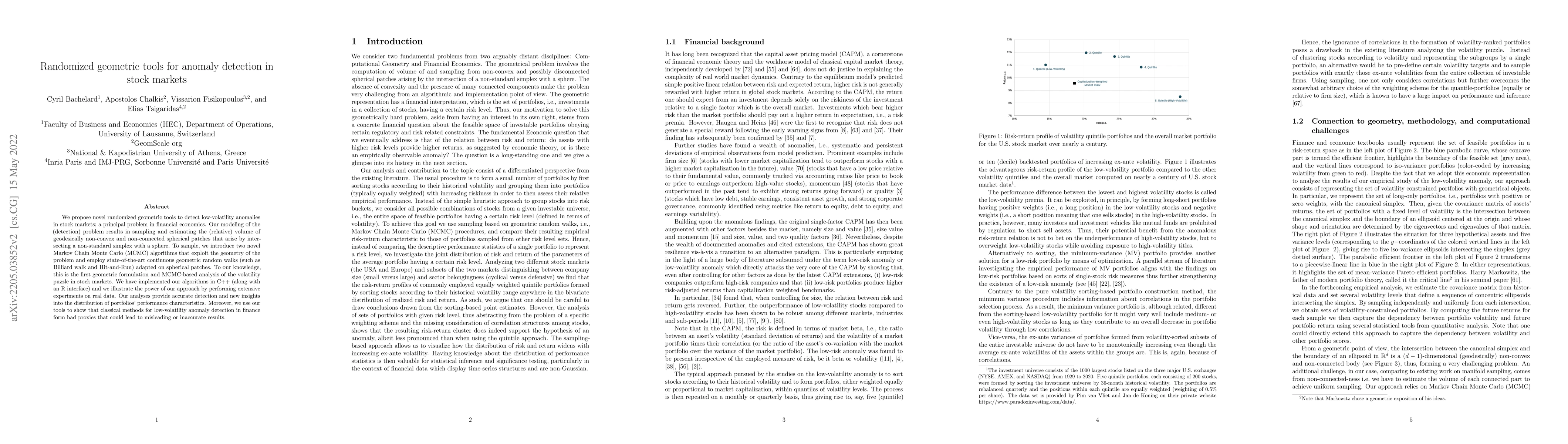

We propose novel randomized geometric tools to detect low-volatility anomalies in stock markets; a principal problem in financial economics. Our modeling of the (detection) problem results in sampling and estimating the (relative) volume of geodesically non-convex and non-connected spherical patches that arise by intersecting a non-standard simplex with a sphere. To sample, we introduce two novel Markov Chain Monte Carlo (MCMC) algorithms that exploit the geometry of the problem and employ state-of-the-art continuous geometric random walks (such as Billiard walk and Hit-and-Run) adapted on spherical patches. To our knowledge, this is the first geometric formulation and MCMC-based analysis of the volatility puzzle in stock markets. We have implemented our algorithms in C++ (along with an R interface) and we illustrate the power of our approach by performing extensive experiments on real data. Our analyses provide accurate detection and new insights into the distribution of portfolios' performance characteristics. Moreover, we use our tools to show that classical methods for low-volatility anomaly detection in finance form bad proxies that could lead to misleading or inaccurate results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)