Authors

Summary

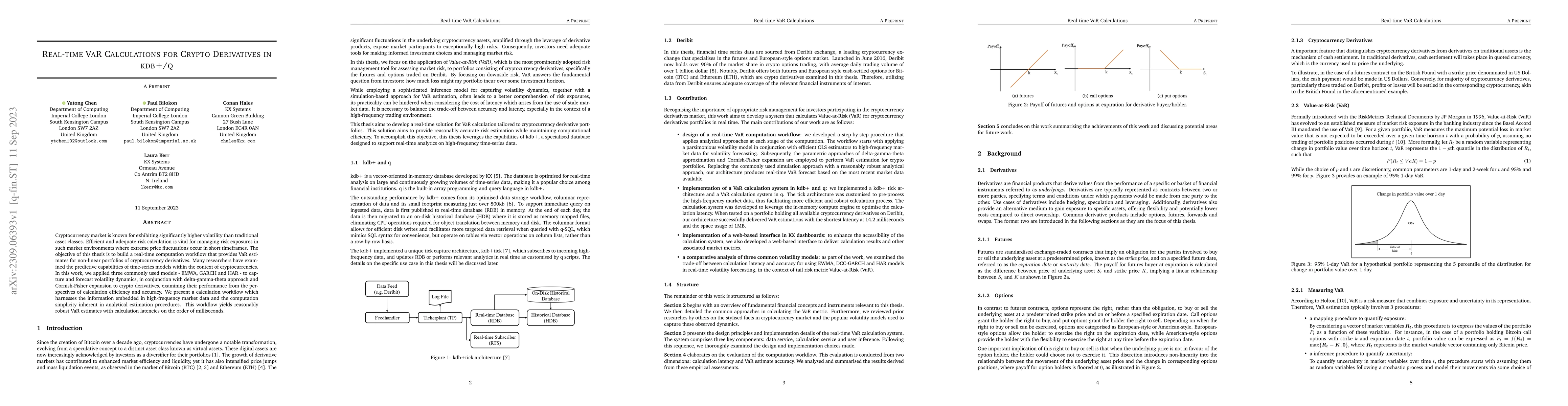

Cryptocurrency market is known for exhibiting significantly higher volatility than traditional asset classes. Efficient and adequate risk calculation is vital for managing risk exposures in such market environments where extreme price fluctuations occur in short timeframes. The objective of this thesis is to build a real-time computation workflow that provides VaR estimates for non-linear portfolios of cryptocurrency derivatives. Many researchers have examined the predictive capabilities of time-series models within the context of cryptocurrencies. In this work, we applied three commonly used models - EMWA, GARCH and HAR - to capture and forecast volatility dynamics, in conjunction with delta-gamma-theta approach and Cornish-Fisher expansion to crypto derivatives, examining their performance from the perspectives of calculation efficiency and accuracy. We present a calculation workflow which harnesses the information embedded in high-frequency market data and the computation simplicity inherent in analytical estimation procedures. This workflow yields reasonably robust VaR estimates with calculation latencies on the order of milliseconds.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReal-time Risk Metrics for Programmatic Stablecoin Crypto Asset-Liability Management (CALM)

Marcel Bluhm, Adrian Cachinero Vasiljević, Sébastien Derivaux et al.

Withanolide derivatives from Physalis angulata var. villosa and their cytotoxic activities.

Zhang, Yu, Yi, Ping, Wang, Peng et al.

Modeling and Analysis of Crypto-Backed Over-Collateralized Stable Derivatives in DeFi

Bhaskar Krishnamachari, Zhenbang Feng, Hardhik Mohanty

No citations found for this paper.

Comments (0)