Summary

We show that the Realized GARCH model yields close-form expression for both the Volatility Index (VIX) and the volatility risk premium (VRP). The Realized GARCH model is driven by two shocks, a return shock and a volatility shock, and these are natural state variables in the stochastic discount factor (SDF). The volatility shock endows the exponentially affine SDF with a compensation for volatility risk. This leads to dissimilar dynamic properties under the physical and risk-neutral measures that can explain time-variation in the VRP. In an empirical application with the S&P 500 returns, the VIX, and the VRP, we find that the Realized GARCH model significantly outperforms conventional GARCH models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

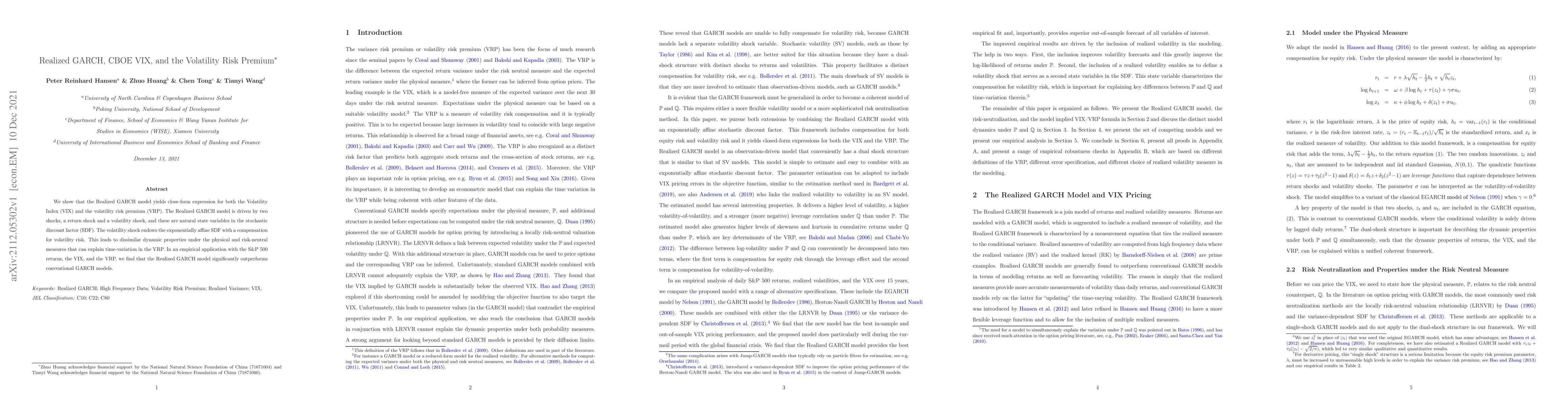

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Hybrid Forecast of S&P 500 Volatility ensembled from VIX, GARCH and LSTM models

Natalia Roszyk, Robert Ślepaczuk

Roughness Analysis of Realized Volatility and VIX through Randomized Kolmogorov-Smirnov Distribution

Daniele Angelini, Sergio Bianchi

A Bayesian realized threshold measurement GARCH framework for financial tail risk forecasting

Chao Wang, Richard Gerlach

| Title | Authors | Year | Actions |

|---|

Comments (0)