Summary

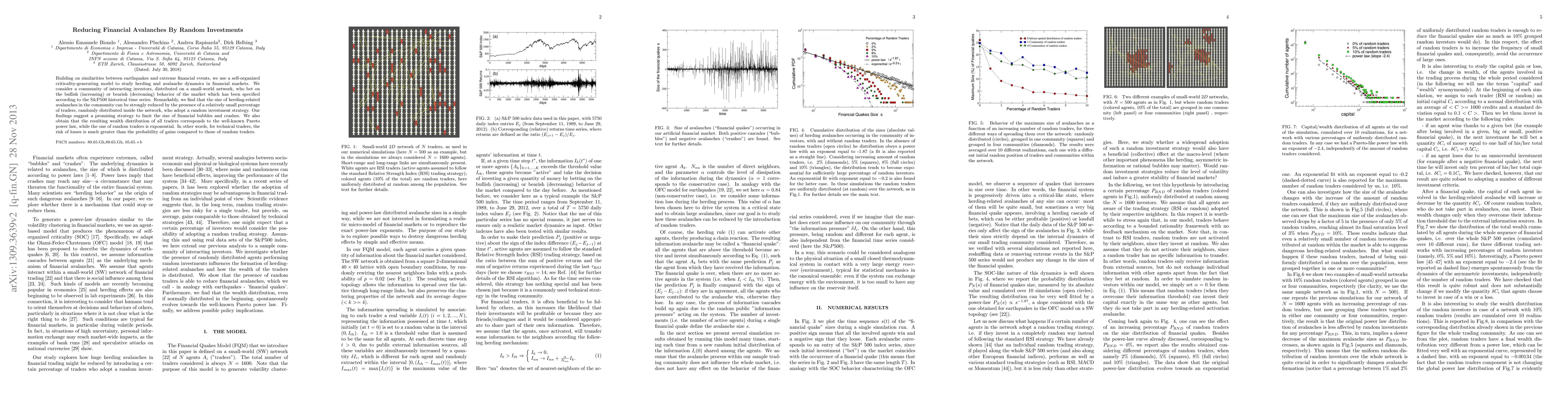

Building on similarities between earthquakes and extreme financial events, we use a self-organized criticality-generating model to study herding and avalanche dynamics in financial markets. We consider a community of interacting investors, distributed on a small-world network, who bet on the bullish (increasing) or bearish (decreasing) behavior of the market which has been specified according to the S&P500 historical time series. Remarkably, we find that the size of herding-related avalanches in the community can be strongly reduced by the presence of a relatively small percentage of traders, randomly distributed inside the network, who adopt a random investment strategy. Our findings suggest a promising strategy to limit the size of financial bubbles and crashes. We also obtain that the resulting wealth distribution of all traders corresponds to the well-known Pareto power law, while the one of random traders is exponential. In other words, for technical traders, the risk of losses is much greater than the probability of gains compared to those of random traders.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinancial instability transition under heterogeneous investments and portfolio diversification

Silvia Bartolucci, Sabrina Aufiero, Preben Forer et al.

Bayesian Optimization of ESG Financial Investments

Eduardo C. Garrido-Merchán, Gabriel González Piris, Maria Coronado Vaca

| Title | Authors | Year | Actions |

|---|

Comments (0)