Summary

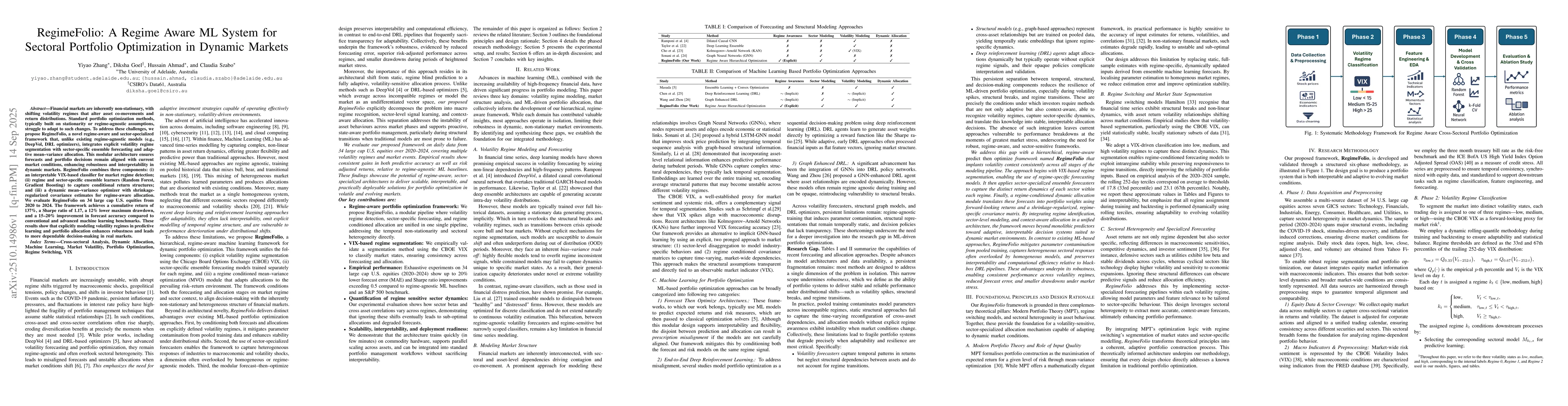

Financial markets are inherently non-stationary, with shifting volatility regimes that alter asset co-movements and return distributions. Standard portfolio optimization methods, typically built on stationarity or regime-agnostic assumptions, struggle to adapt to such changes. To address these challenges, we propose RegimeFolio, a novel regime-aware and sector-specialized framework that, unlike existing regime-agnostic models such as DeepVol and DRL optimizers, integrates explicit volatility regime segmentation with sector-specific ensemble forecasting and adaptive mean-variance allocation. This modular architecture ensures forecasts and portfolio decisions remain aligned with current market conditions, enhancing robustness and interpretability in dynamic markets. RegimeFolio combines three components: (i) an interpretable VIX-based classifier for market regime detection; (ii) regime and sector-specific ensemble learners (Random Forest, Gradient Boosting) to capture conditional return structures; and (iii) a dynamic mean-variance optimizer with shrinkage-regularized covariance estimates for regime-aware allocation. We evaluate RegimeFolio on 34 large cap U.S. equities from 2020 to 2024. The framework achieves a cumulative return of 137 percent, a Sharpe ratio of 1.17, a 12 percent lower maximum drawdown, and a 15 to 20 percent improvement in forecast accuracy compared to conventional and advanced machine learning benchmarks. These results show that explicitly modeling volatility regimes in predictive learning and portfolio allocation enhances robustness and leads to more dependable decision-making in real markets.

AI Key Findings

Generated Nov 01, 2025

Methodology

The study employs a regime-aware portfolio optimization framework combining volatility-based regime segmentation, sector-specialized ensemble forecasting, and dynamic allocation with robust risk modeling.

Key Results

- 15-20% reduction in forecasting error

- 137.0% cumulative return over evaluation period

- 1.17 Sharpe ratio with notable reduction in maximum drawdown

Significance

This research provides a scalable, interpretable framework for improving portfolio performance in volatile markets with significant implications for institutional investment management.

Technical Contribution

Proposes a regime-conditioned, shrinkage-regularized covariance matrix approach for improved risk estimation stability

Novelty

Integrates sector-specific modeling with volatility regime segmentation in a modular framework for adaptive portfolio allocation

Limitations

- Focus on U.S. large-cap equities

- Assumes local stationarity within regimes

Future Work

- Extend framework to multi-asset universes

- Develop hybrid regime classifiers integrating macroeconomic indicators

- Explore alternative optimization methods incorporating higher-order moments

Paper Details

PDF Preview

Similar Papers

Found 5 papersSectoral portfolio optimization by judicious selection of financial ratios via PCA

Vrinda Dhingra, Amita Sharma, Shiv K. Gupta

Risk-aware Trading Portfolio Optimization

Gianmarco De Francisci Morales, Gabriele D'Acunto, Fabio Vitale et al.

Dynamic Portfolio Optimization with Inverse Covariance Clustering

Tomaso Aste, Yuanrong Wang

Comments (0)