Summary

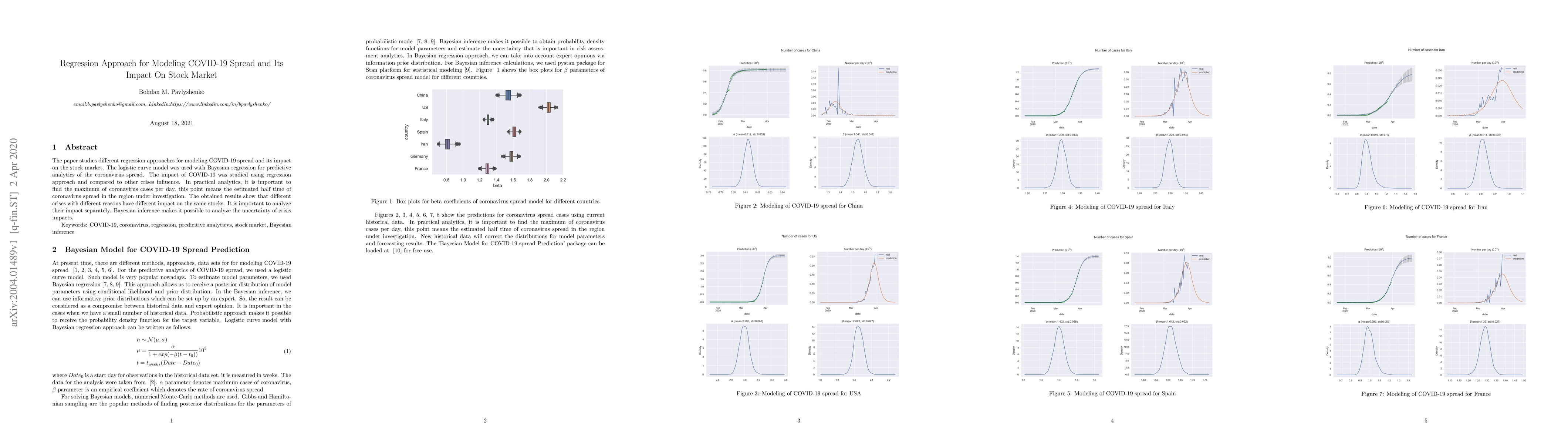

The paper studies different regression approaches for modeling COVID-19 spread and its impact on the stock market. The logistic curve model was used with Bayesian regression for predictive analytics of the coronavirus spread. The impact of COVID-19 was studied using regression approach and compared to other crises influence. In practical analytics, it is important to find the maximum of coronavirus cases per day, this point means the estimated half time of coronavirus spread in the region under investigation. The obtained results show that different crises with different reasons have different impact on the same stocks. It is important to analyze their impact separately. Bayesian inference makes it possible to analyze the uncertainty of crisis impacts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)