Authors

Summary

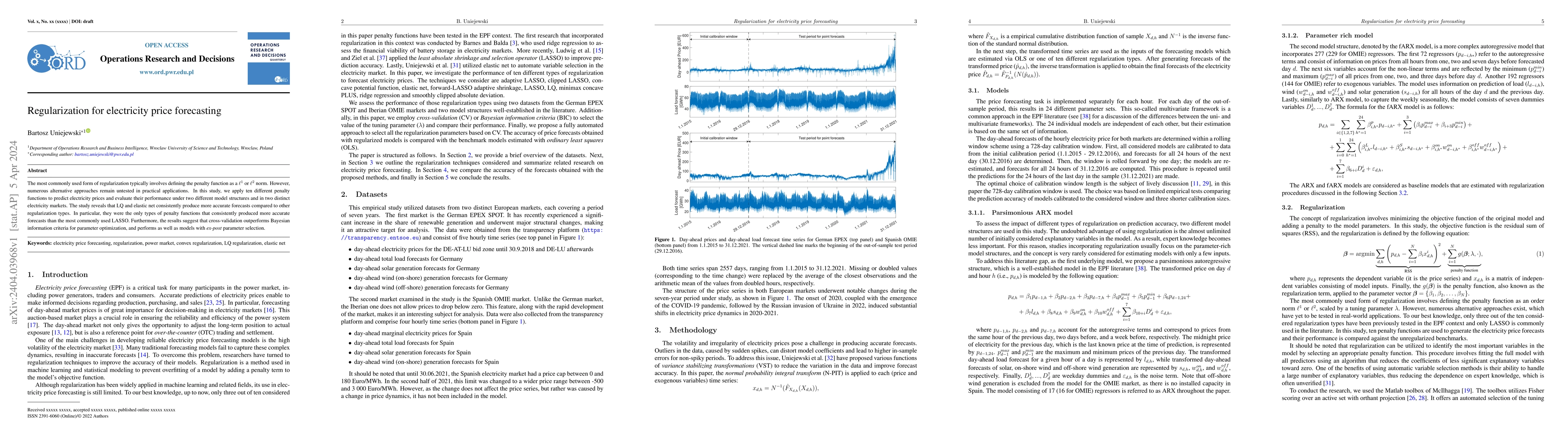

The most commonly used form of regularization typically involves defining the penalty function as a L1 or L2 norm. However, numerous alternative approaches remain untested in practical applications. In this study, we apply ten different penalty functions to predict electricity prices and evaluate their performance under two different model structures and in two distinct electricity markets. The study reveals that LQ and elastic net consistently produce more accurate forecasts compared to other regularization types. In particular, they were the only types of penalty functions that consistently produced more accurate forecasts than the most commonly used LASSO. Furthermore, the results suggest that cross-validation outperforms Bayesian information criteria for parameter optimization, and performs as well as models with ex-post parameter selection.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransfer Learning for Electricity Price Forecasting

Ilkay Oksuz, Salih Gunduz, Umut Ugurlu

Distributional neural networks for electricity price forecasting

Florian Ziel, Rafał Weron, Grzegorz Marcjasz et al.

Statistical electricity price forecasting: A structural approach

Raffaele Sgarlato

| Title | Authors | Year | Actions |

|---|

Comments (0)