Summary

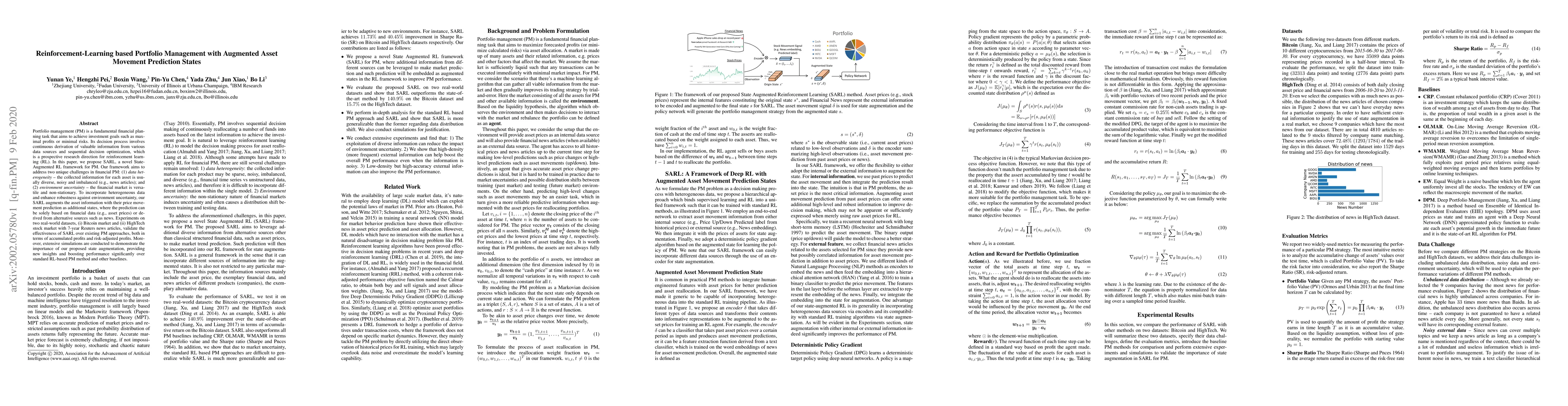

Portfolio management (PM) is a fundamental financial planning task that aims to achieve investment goals such as maximal profits or minimal risks. Its decision process involves continuous derivation of valuable information from various data sources and sequential decision optimization, which is a prospective research direction for reinforcement learning (RL). In this paper, we propose SARL, a novel State-Augmented RL framework for PM. Our framework aims to address two unique challenges in financial PM: (1) data heterogeneity -- the collected information for each asset is usually diverse, noisy and imbalanced (e.g., news articles); and (2) environment uncertainty -- the financial market is versatile and non-stationary. To incorporate heterogeneous data and enhance robustness against environment uncertainty, our SARL augments the asset information with their price movement prediction as additional states, where the prediction can be solely based on financial data (e.g., asset prices) or derived from alternative sources such as news. Experiments on two real-world datasets, (i) Bitcoin market and (ii) HighTech stock market with 7-year Reuters news articles, validate the effectiveness of SARL over existing PM approaches, both in terms of accumulated profits and risk-adjusted profits. Moreover, extensive simulations are conducted to demonstrate the importance of our proposed state augmentation, providing new insights and boosting performance significantly over standard RL-based PM method and other baselines.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA General Framework on Enhancing Portfolio Management with Reinforcement Learning

Yinheng Li, Junhao Wang, Yijie Cao

Diffusion-Augmented Reinforcement Learning for Robust Portfolio Optimization under Stress Scenarios

Himanshu Choudhary, Arishi Orra, Manoj Thakur

| Title | Authors | Year | Actions |

|---|

Comments (0)