Authors

Summary

This paper establishes a new and comprehensive theoretical analysis for the application of reinforcement learning (RL) in high-frequency market making. We bridge the modern RL theory and the continuous-time statistical models in high-frequency financial economics. Different with most existing literature on methodological research about developing various RL methods for market making problem, our work is a pilot to provide the theoretical analysis. We target the effects of sampling frequency, and find an interesting tradeoff between error and complexity of RL algorithm when tweaking the values of the time increment $\Delta$ $-$ as $\Delta$ becomes smaller, the error will be smaller but the complexity will be larger. We also study the two-player case under the general-sum game framework and establish the convergence of Nash equilibrium to the continuous-time game equilibrium as $\Delta\rightarrow0$. The Nash Q-learning algorithm, which is an online multi-agent RL method, is applied to solve the equilibrium. Our theories are not only useful for practitioners to choose the sampling frequency, but also very general and applicable to other high-frequency financial decision making problems, e.g., optimal executions, as long as the time-discretization of a continuous-time markov decision process is adopted. Monte Carlo simulation evidence support all of our theories.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

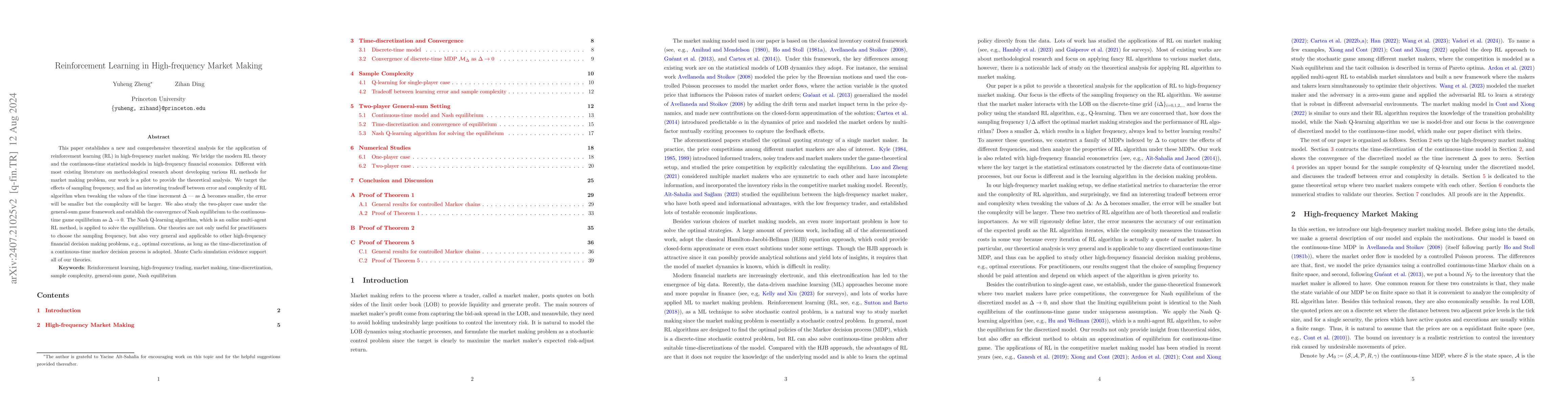

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket Making via Reinforcement Learning in China Commodity Market

Junshu Jiang, Thomas Dierckx, Wim Schoutens et al.

No citations found for this paper.

Comments (0)