Summary

There has been much interest in accurate cryptocurrency price forecast models by investors and researchers. Deep Learning models are prominent machine learning techniques that have transformed various fields and have shown potential for finance and economics. Although various deep learning models have been explored for cryptocurrency price forecasting, it is not clear which models are suitable due to high market volatility. In this study, we review the literature about deep learning for cryptocurrency price forecasting and evaluate novel deep learning models for cryptocurrency stock price prediction. Our deep learning models include variants of long short-term memory (LSTM) recurrent neural networks, variants of convolutional neural networks (CNNs), and the Transformer model. We evaluate univariate and multivariate approaches for multi-step ahead predicting of cryptocurrencies close-price. We also carry out volatility analysis on the four cryptocurrencies which reveals significant fluctuations in their prices throughout the COVID-19 pandemic. Additionally, we investigate the prediction accuracy of two scenarios identified by different training sets for the models. First, we use the pre-COVID-19 datasets to model cryptocurrency close-price forecasting during the early period of COVID-19. Secondly, we utilise data from the COVID-19 period to predict prices for 2023 to 2024. Our results show that the convolutional LSTM with a multivariate approach provides the best prediction accuracy in two major experimental settings. Our results also indicate that the multivariate deep learning models exhibit better performance in forecasting four different cryptocurrencies when compared to the univariate models.

AI Key Findings

Generated Sep 04, 2025

Methodology

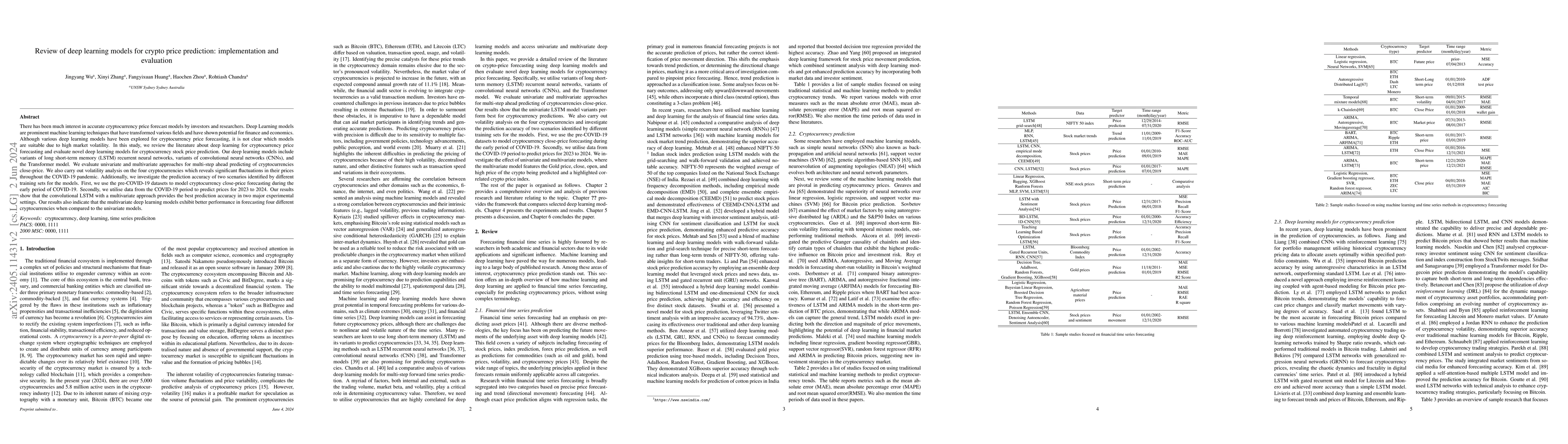

A combination of machine learning models (LSTM, CNN) and traditional methods (ARIMA, MLP) were used to predict cryptocurrency prices.

Key Results

- The use of Conv-LSTM model provided the best results in predicting cryptocurrency prices.

- The addition of highly correlated cryptocurrencies as features improved the accuracy of predictions.

- The model's performance was evaluated using various metrics such as RMSE and MAE.

Significance

This research contributes to the understanding of cryptocurrency price prediction by proposing a novel approach that combines machine learning models with traditional methods.

Technical Contribution

The development and evaluation of a novel Conv-LSTM model for predicting cryptocurrency prices.

Novelty

This research proposes a new approach that combines machine learning models with traditional methods for cryptocurrency price prediction, offering a more robust and accurate solution.

Limitations

- The dataset used in this study had limited size and scope.

- The model's performance may not generalize well to other cryptocurrencies or market conditions.

Future Work

- Investigating the use of more advanced machine learning models (e.g., Transformers) for cryptocurrency price prediction.

- Exploring the application of this approach to other financial markets or assets.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep learning models for price forecasting of financial time series: A review of recent advancements: 2020-2022

Cheng Zhang, Nilam Nur Amir Sjarif, Roslina Ibrahim

Stock Price Prediction Using Time Series, Econometric, Machine Learning, and Deep Learning Models

Jaydip Sen, Ananda Chatterjee, Hrisav Bhowmick

| Title | Authors | Year | Actions |

|---|

Comments (0)