Summary

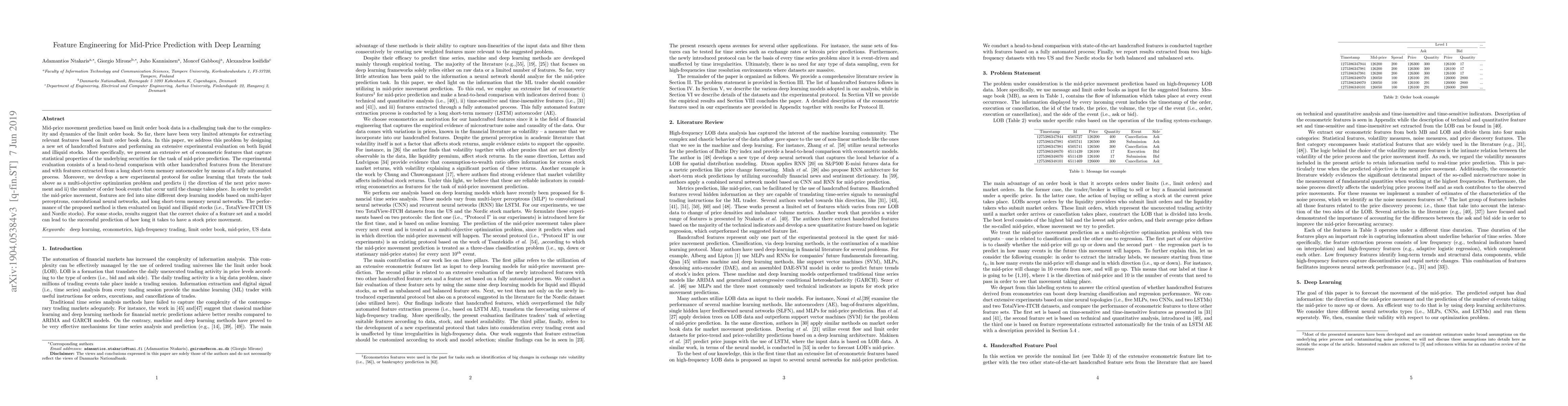

Mid-price movement prediction based on limit order book (LOB) data is a challenging task due to the complexity and dynamics of the LOB. So far, there have been very limited attempts for extracting relevant features based on LOB data. In this paper, we address this problem by designing a new set of handcrafted features and performing an extensive experimental evaluation on both liquid and illiquid stocks. More specifically, we implement a new set of econometrical features that capture statistical properties of the underlying securities for the task of mid-price prediction. Moreover, we develop a new experimental protocol for online learning that treats the task as a multi-objective optimization problem and predicts i) the direction of the next price movement and ii) the number of order book events that occur until the change takes place. In order to predict the mid-price movement, the features are fed into nine different deep learning models based on multi-layer perceptrons (MLP), convolutional neural networks (CNN) and long short-term memory (LSTM) neural networks. The performance of the proposed method is then evaluated on liquid and illiquid stocks, which are based on TotalView-ITCH US and Nordic stocks, respectively. For some stocks, results suggest that the correct choice of a feature set and a model can lead to the successful prediction of how long it takes to have a stock price movement.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLLM-Enhanced Feature Engineering for Multi-Factor Electricity Price Predictions

Chong Zhang, Yuxuan Chen, Jiayi Liu et al.

Review of deep learning models for crypto price prediction: implementation and evaluation

Xinyi Zhang, Jingyang Wu, Fangyixuan Huang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)