Summary

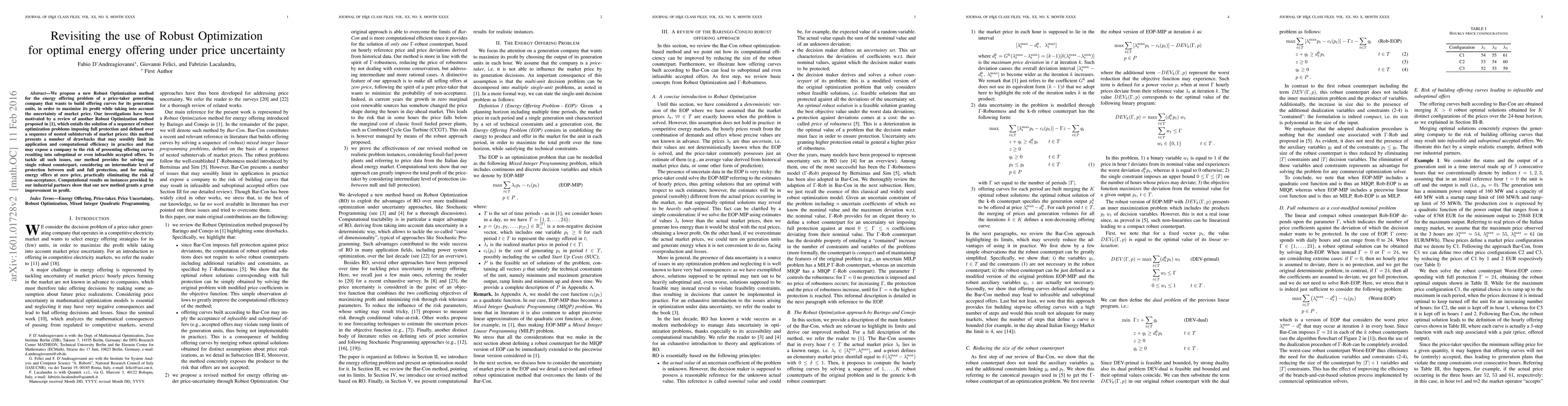

We propose a new Robust Optimization method for the energy offering problem of a price-taker generating company that wants to build offering curves for its generation units, in order to maximize its profit while taking into account the uncertainty of market price. Our investigations have been motivated by a critique to another Robust Optimization method proposed in [Baringo and Conejo, 2011], which entails the solution of a sequence of robust optimization problems imposing full protection and defined over a sequence of nested subintervals of market prices: this method presents a number of issues that may severely limit its application and computational efficiency in practice and that may expose a company to the risk of presenting offering curves resulting into suboptimal or even infeasible accepted offers. To tackle all such issues, our method provides for solving one single robust counterpart, considering an intermediate level of protection between null and full protection, and to make energy offers at zero price, practically eliminating the risk of non-acceptance. Computational results on instances provided by our industrial partners show that our new method is able to grant a great improvement in profit.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnergy Storage Arbitrage Under Price Uncertainty: Market Risks and Opportunities

James Anderson, Bolun Xu, Yiqian Wu

Optimal day-ahead offering strategy for large producers based on market price response learning

António Alcántara, Carlos Ruiz

| Title | Authors | Year | Actions |

|---|

Comments (0)