Summary

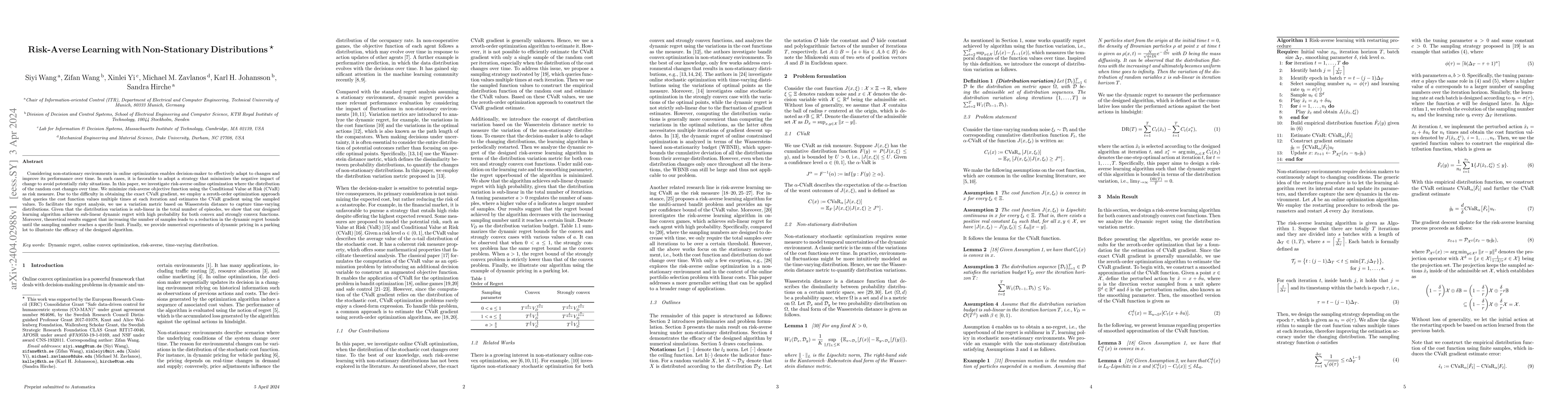

Considering non-stationary environments in online optimization enables decision-maker to effectively adapt to changes and improve its performance over time. In such cases, it is favorable to adopt a strategy that minimizes the negative impact of change to avoid potentially risky situations. In this paper, we investigate risk-averse online optimization where the distribution of the random cost changes over time. We minimize risk-averse objective function using the Conditional Value at Risk (CVaR) as risk measure. Due to the difficulty in obtaining the exact CVaR gradient, we employ a zeroth-order optimization approach that queries the cost function values multiple times at each iteration and estimates the CVaR gradient using the sampled values. To facilitate the regret analysis, we use a variation metric based on Wasserstein distance to capture time-varying distributions. Given that the distribution variation is sub-linear in the total number of episodes, we show that our designed learning algorithm achieves sub-linear dynamic regret with high probability for both convex and strongly convex functions. Moreover, theoretical results suggest that increasing the number of samples leads to a reduction in the dynamic regret bounds until the sampling number reaches a specific limit. Finally, we provide numerical experiments of dynamic pricing in a parking lot to illustrate the efficacy of the designed algorithm.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk-averse learning with delayed feedback

Zifan Wang, Sandra Hirche, Karl Henrik Johansson et al.

Stationary Policies are Optimal in Risk-averse Total-reward MDPs with EVaR

Xihong Su, Marek Petrik, Julien Grand-Clément

Risk-Averse Total-Reward Reinforcement Learning

Xihong Su, Marek Petrik, Jia Lin Hau et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)