Authors

Summary

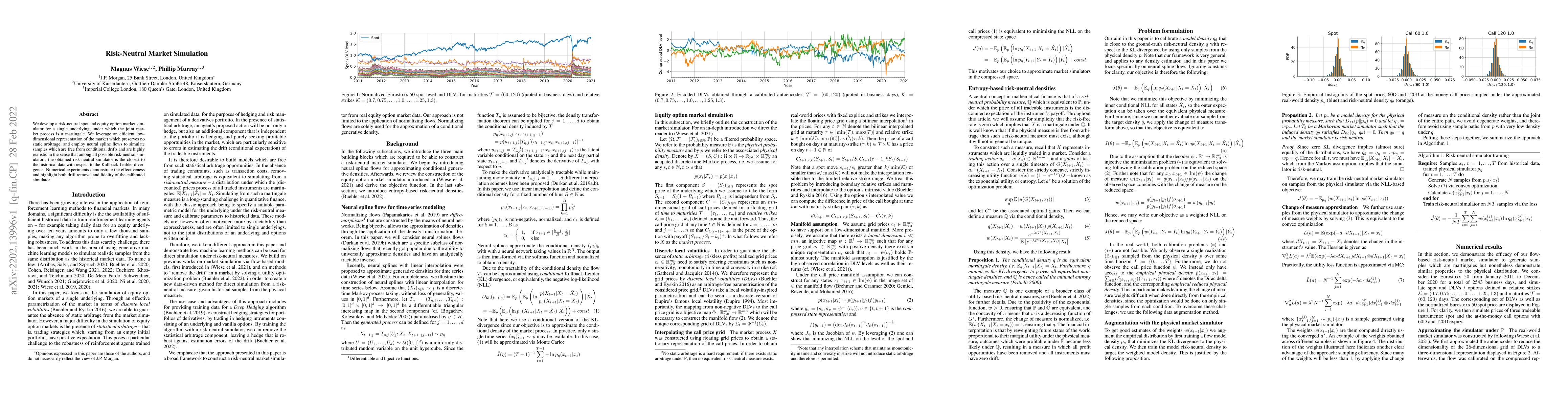

We develop a risk-neutral spot and equity option market simulator for a single underlying, under which the joint market process is a martingale. We leverage an efficient low-dimensional representation of the market which preserves no static arbitrage, and employ neural spline flows to simulate samples which are free from conditional drifts and are highly realistic in the sense that among all possible risk-neutral simulators, the obtained risk-neutral simulator is the closest to the historical data with respect to the Kullback-Leibler divergence. Numerical experiments demonstrate the effectiveness and highlight both drift removal and fidelity of the calibrated simulator.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk Premia in the Bitcoin Market

Ratmir Miftachov, Zijin Wang, Caio Almeida et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)