Authors

Summary

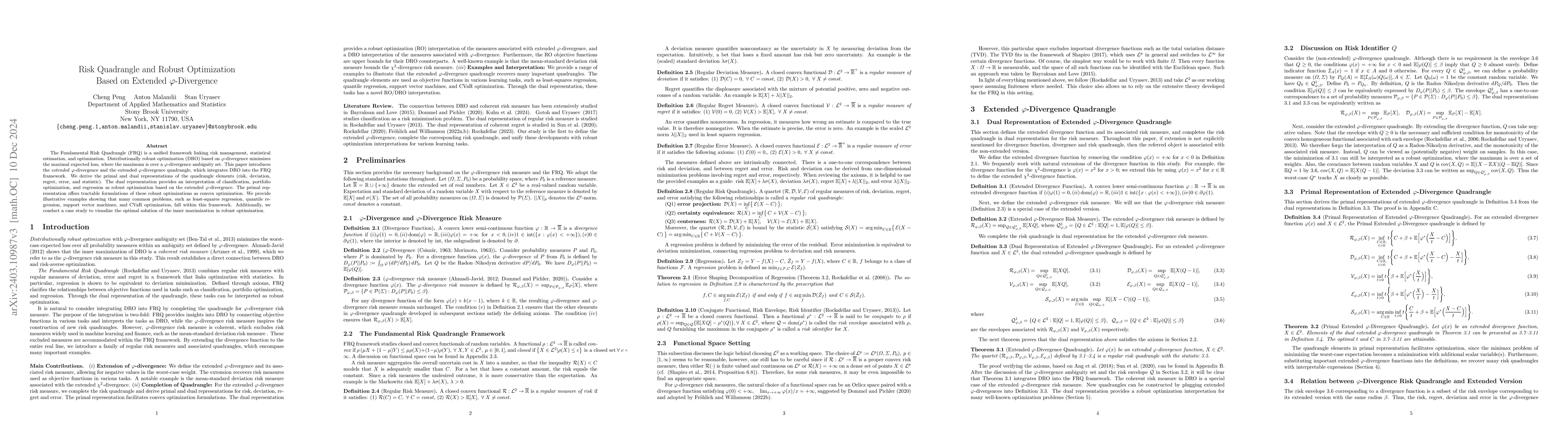

This paper studies robust and distributionally robust optimization based on the extended $\varphi$-divergence under the Fundamental Risk Quadrangle framework. We present the primal and dual representations of the quadrangle elements: risk, deviation, regret, error, and statistic. The framework provides an interpretation of portfolio optimization, classification and regression as robust optimization. We furnish illustrative examples demonstrating that many common problems are included in this framework. The $\varphi$-divergence risk measure used in distributionally robust optimization is a special case. We conduct a case study to visualize the risk envelope.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersDivergence Based Quadrangle and Applications

Cheng Peng, Anton Malandii, Stan Uryasev et al.

Support Vector Regression: Risk Quadrangle Framework

Anton Malandii, Stan Uryasev

Distributionally Robust Bayesian Optimization with $\varphi$-divergences

Anton van den Hengel, Hisham Husain, Vu Nguyen

Random Distributionally Robust Optimization under Phi-divergence

Zongxia Liang, Guohui Guan, Xingjian Ma

No citations found for this paper.

Comments (0)