Authors

Summary

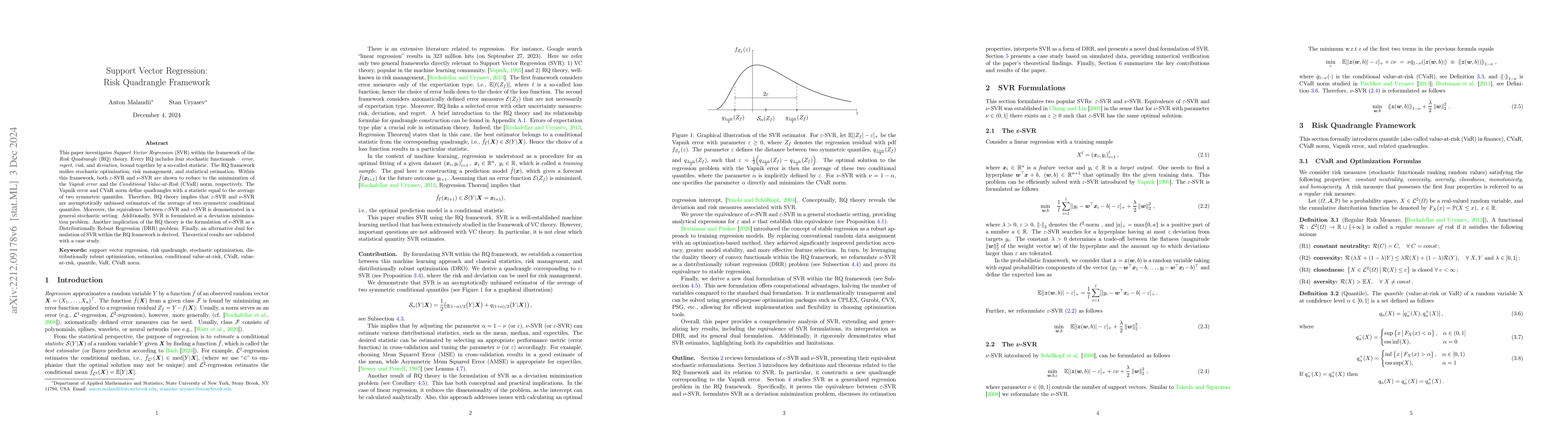

This paper investigates Support Vector Regression (SVR) in the context of the fundamental risk quadrangle theory, which links optimization, risk management, and statistical estimation. It is shown that both formulations of SVR, $\varepsilon$-SVR and $\nu$-SVR, correspond to the minimization of equivalent error measures (Vapnik error and CVaR norm, respectively) with a regularization penalty. These error measures, in turn, define the corresponding risk quadrangles. By constructing the fundamental risk quadrangle, which corresponds to SVR, we show that SVR is the asymptotically unbiased estimator of the average of two symmetric conditional quantiles. Further, we prove the equivalence of the $\varepsilon$-SVR and $\nu$-SVR in a general stochastic setting. Additionally, SVR is formulated as a regular deviation minimization problem with a regularization penalty. Finally, the dual formulation of SVR in the risk quadrangle framework is derived.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk Quadrangle and Robust Optimization Based on $\varphi$-Divergence

Cheng Peng, Anton Malandii, Stan Uryasev

Divergence Based Quadrangle and Applications

Cheng Peng, Anton Malandii, Stan Uryasev et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)