Summary

We investigate the generative capabilities of the Schr\"odinger Bridge (SB) approach for time series. The SB framework formulates time series synthesis as an entropic optimal interpolation transport problem between a reference probability measure on path space and a target joint distribution. This results in a stochastic differential equation over a finite horizon that accurately captures the temporal dynamics of the target time series. While the SB approach has been largely explored in fields like image generation, there is a scarcity of studies for its application to time series. In this work, we bridge this gap by conducting a comprehensive evaluation of the SB method's robustness and generative performance. We benchmark it against state-of-the-art (SOTA) time series generation methods across diverse datasets, assessing its strengths, limitations, and capacity to model complex temporal dependencies. Our results offer valuable insights into the SB framework's potential as a versatile and robust tool for time series generation.

AI Key Findings

Generated Jun 10, 2025

Methodology

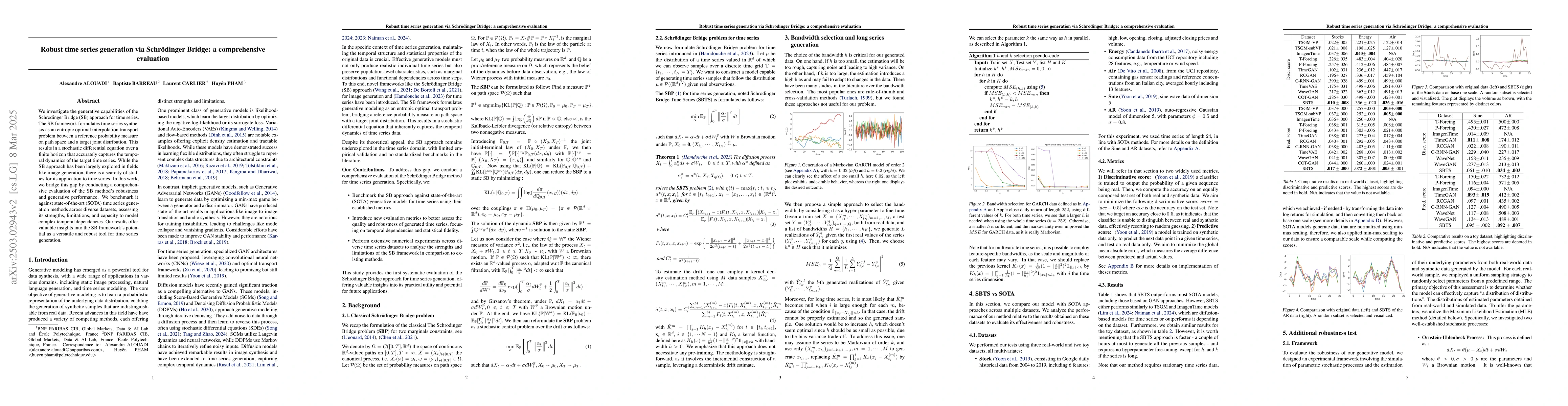

The research evaluates the Schrödinger Bridge (SB) approach for time series generation, formulating it as an entropic optimal interpolation transport problem. This results in a stochastic differential equation capturing temporal dynamics, which is then benchmarked against state-of-the-art (SOTA) time series generation methods.

Key Results

- SBTS outperforms most SOTA models, including GAN approaches, and achieves performance comparable to diffusion-based models.

- SBTS is simpler, requiring no pre-training, minimal parameter tuning, and enabling fast data generation without significant computational power.

- The method demonstrates robustness across diverse datasets, including Stock, Energy, Air, Sine, and AR datasets.

- Despite its strengths, SBTS is sensitive to kernel bandwidth choice and assumes constant variance, which may not accurately model time series with stochastic volatility.

Significance

This study demonstrates the effectiveness of the SBTS approach for generating high-quality time series data, offering a simpler, faster, and robust alternative to complex GAN and diffusion-based models, with potential applications across various domains.

Technical Contribution

The paper introduces a novel application of the Schrödinger Bridge framework for robust time series generation, formulating it as an optimal transport problem and solving it via a stochastic differential equation.

Novelty

While the Schrödinger Bridge has been explored in image generation, this research is among the first to apply it comprehensively to time series generation, offering valuable insights into its potential as a versatile tool for this domain.

Limitations

- The kernel-based approach used to approximate the drift is sensitive to kernel bandwidth selection, which can hinder performance, especially for long time series.

- The current SBTS model assumes constant variance, which may be insufficient for accurately modeling time series with stochastic volatility, a common feature in financial data.

Future Work

- Further refinement of SBTS to better capture volatility-related parameter nuances.

- Integration of stochastic variance into the SBTS framework to improve its robustness in modeling time series with stochastic volatility.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLeveraging Priors via Diffusion Bridge for Time Series Generation

Jaewook Lee, Jinseong Park, Seungyun Lee et al.

A Comprehensive Benchmark for Electrocardiogram Time-Series

Jianqiang Huang, Yuhua Zheng, Jiaxin Qi et al.

BRIDGE: Bootstrapping Text to Control Time-Series Generation via Multi-Agent Iterative Optimization and Diffusion Modelling

Goran Nenadic, Hao Li, Jiang Bian et al.

No citations found for this paper.

Comments (0)