Summary

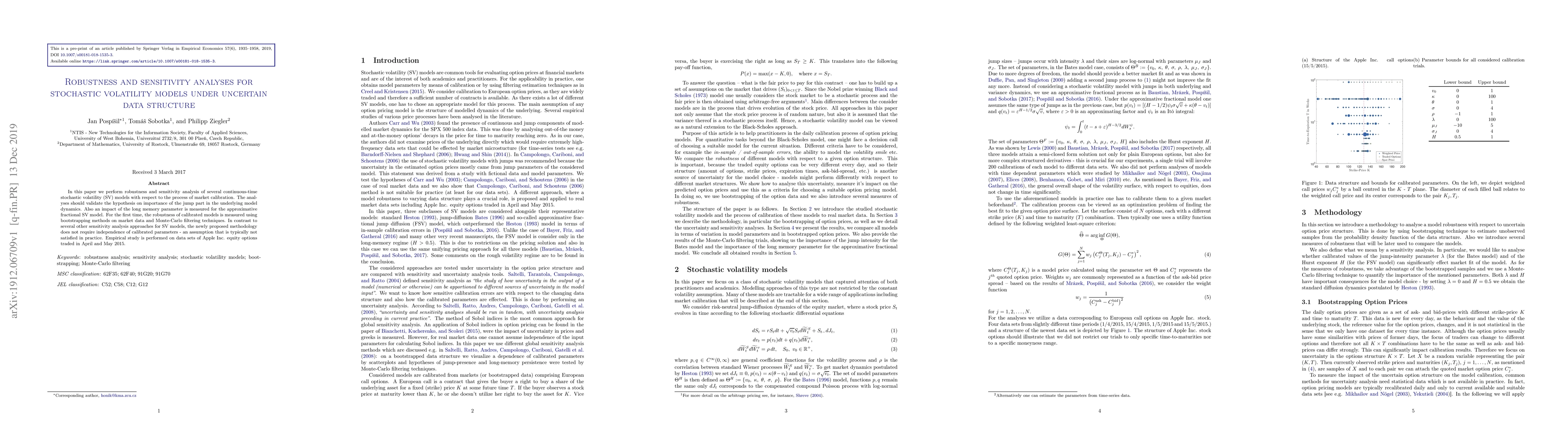

In this paper we perform robustness and sensitivity analysis of several continuous-time stochastic volatility (SV) models with respect to the process of market calibration. The analyses should validate the hypothesis on importance of the jump part in the underlying model dynamics. Also an impact of the long memory parameter is measured for the approximative fractional SV model. For the first time, the robustness of calibrated models is measured using bootstrapping methods on market data and Monte-Carlo filtering techniques. In contrast to several other sensitivity analysis approaches for SV models, the newly proposed methodology does not require independence of calibrated parameters - an assumption that is typically not satisfied in practice. Empirical study is performed on data sets of Apple Inc. equity options traded in April and May 2015.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobustness and sensitivity analyses for rough Volterra stochastic volatility models

Jan Pospíšil, Jan Matas

Robustness of Hilbert space-valued stochastic volatility models

Fred Espen Benth, Heidar Eyjolfsson

| Title | Authors | Year | Actions |

|---|

Comments (0)